Buying Stocks

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Am I Buying Stocks or Shares

Buying stocks online is the easy part of the online stock trading game. When I buy stocks online, I am actually buying shares in the company. The market capitalization of a company can be found by multiplying the price of the stock x the number of shares which the company has. Thus, the market capitalization of a company which has 25,000,000 shares and trades at $20.00 is $500,000,000. When I purchase 1,000 shares for $20 per share it will cost me $20,000 and I will own 1/25,000 of the company.

By creating an account with an online broker once all of the paperwork is done and you have deposited funds into the account you should be ready to buy shares in your favourite companies and begin stock trading.

When you have purchased a number of different companies then you will be holding in your online account shares in these companies. In a takeover situation, your shares will be automatically transferred to the company doing the takeover unless you sell your shares prior to the deadline.

Buying Stocks for Dividends

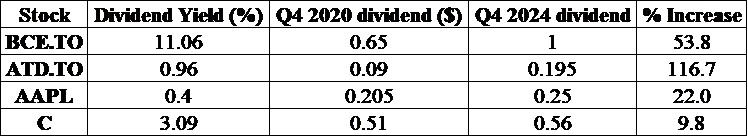

Numerous studies have shown that strong dividend growers have a higher long term return than companies that pay a high dividend yield. One of these studies can be seen in a document written about dividend growers on the Dividend Stocks Rock webpage. When you compare a dividend grower to a high yielding stock it is evident that the best strategy is to buy stocks in high dividend growers and sell some of the shares as a way to generate the equivalent income that a dividend payer would pay out.

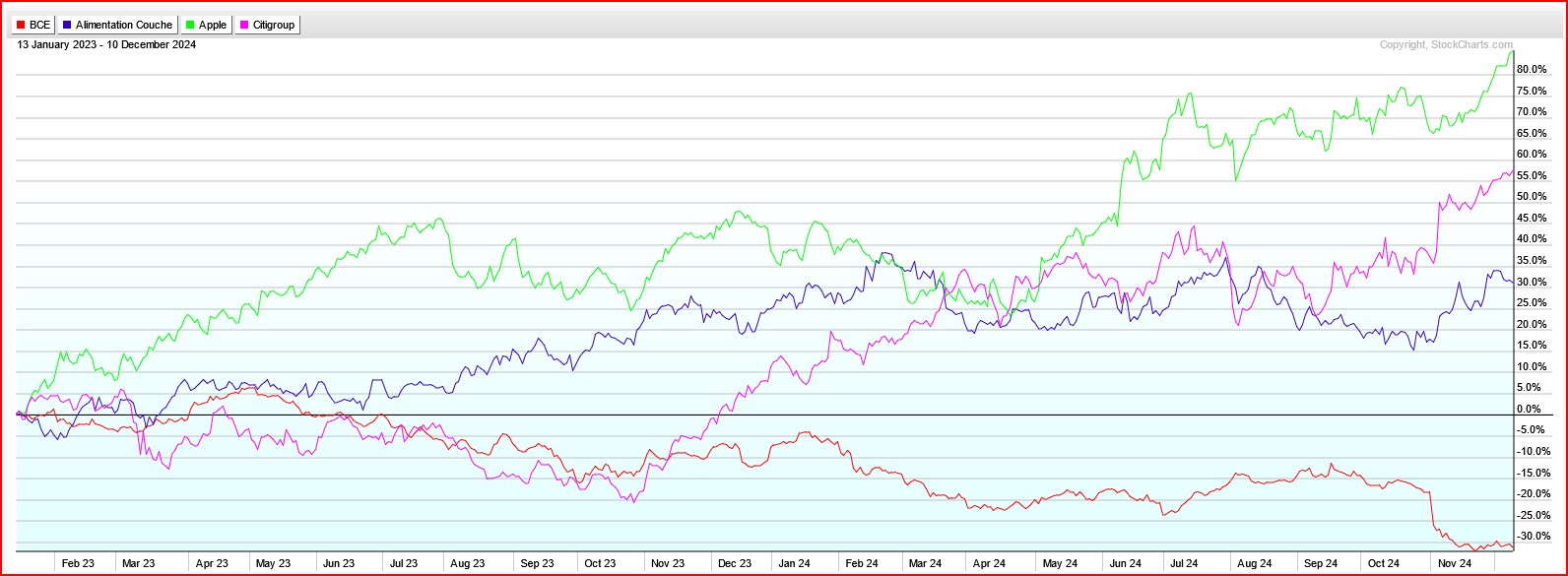

The chart below (Dec 2020 to Dec 2024) compares the share prices of 2 Canadian (BCE and ATD) and 2 US (C and AAPL) stocks. The yield and dividend growth data are shown in the table below the chart. From the graph you can see that the dividend grower (ATD) is up about 30 % over the last 4 years while the high dividend payer (BCE) is down 30% over the same time period.

In the case of the US stocks AAPL, the dividend grower is up about 57% while the high dividend payer (C) is up about 31%. By following the above link, you can see more data that essentially shows that the dividend growers typically increase in price more than the high yield dividend payers.

Chart courtesy of StockCharts.com

Buying Stocks on Margin

When you start buying stocks on margin you need to ensure you know what you are doing. When you are using margin, you buy more stock than you have money for and you borrow the remainder from the broker.

As an example in my margin account, I can buy $20,000 worth of stock even though I only have $5,000 worth of cash in the account. This can work really well when the trade is profitable.

Let's say I buy a stock for $10 with a stop loss at $9.50 so I am risking $0.50 per share. It looks like a great trade so I buy 1,000 shares and end up selling at $12.00. I made $2,000 minus commissions and interest on the borrowed money. This is about 40% on my money and I will now have around $7,000 in my account.

Had I not used margin, I would have only been able to purchase 500 shares and make $1,000. Now consider what happens when the trade is a loss and my stop loss gets hit. On the margin trade, I lose $500 or 10% of my account which is alot. In the non margin trade, I lose $250 or 5% which is higher than is typically desired but better than 10%. Normally, one would only risk 1 to 2% of their account on any one trade.

Alternately, you could risk 1 to 2% of your account and be able to buy higher priced stocks when using margin. At the high end you would only risk $100 (0.02 x 5000) on a trade.

To read about other ways of buying stocks, visit our book summaries section on technical analysis.

Buying Stocks You Know

One way to screen stocks is by buying stocks in companies you know. This method of purchasing stocks is generally limited to investors and not traders since when you buy stocks you know you are typically looking for a long term hold instead of a short term trade.

Let's consider a golfer. While playing one day the golfer hears that there is a new ball or golf club available that will add distance to his drive. He goes to the pro shop but they are sold out. Likely the golfer is upset. But here is the trick, does he act on this information and look into the company's stock? Perhaps he has found the next big growth stock simply by noticing something while he plays golf.

People use and consume things everyday, day and night and they are all manufactured by companies. The trick is to identify a new trending company early on in it's cycle.

Everyone knows something about some companies that is not considered insider trading:

- Is it hiring?

- Is it laying off?

- Is production at full scale or cut back?

- Are the people excited about working their?

- Is the parking lot always full?

- Are their products being talked about?

- Is there a lineup in front of their store

You drive by companies everyday.

- Are people working there day and night?

- Is the building in shambles?

Your kids are interested in a new hot item, toy, clothes etc.

- Is it from a small company?

- Does it look like a good investment?

- Has the price of success already been factored in?

However, how many companies can you have an intimate knowledge of? There are about 20,000 companies that trade in North America. It is obviously difficult to know something about them all.

Investing in stocks you know is not a bad idea, but it is not the same as stock trading.

Generally, when people trade stock they use technical analysis or signals from the stock market to make their buying and selling decisions.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00