Risk and Money Management

Money Management can be the difference between making

or loosing money when trading stocks

Trading can be like gambling, if you do not incorporate successful money management and risk management techniques.

Does it seem like your are just rolling the dice when you trade stocks? When this is the case, you should start spending some time examining money and risk management strategies.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

While most people think money management has little to do with winning in the stock market, the real winners know otherwise.

Let's look at some questions you should ask yourself before you trade:

Money management

How should I buy or sell a stock: limit or market?

Limit - reduces slippage and guarantees you will get the price you desire. When you enter a limit order at $32.63 you will either get filled at $32.63 or lower. You should not be filled higher than this as $32.63 is the limit you are willing to pay.

Market - increases the speed at which you will enter the market and can sometimes lead to unexpected surprises on low volume stocks or stocks with a high bid/asked spread. As I write this, Ford (F) is bid $10.82, asked $10.83 with just over 29 million shares traded. When you see a buy in F, buying market will get you in immediately and the slippage might be a cent. On the other hand the bid / ask spread for Titan Machinery (TITN) is $14.66 bid with $14.71 asked with a trading volume of just above 146,000. In this case, a market order will get you in likely at 14.71 although it may end up being a bit higher. Splitting the bid ask and putting in a limit order in at $14.68 or $14.69 will likely get you filled although when the market is moving you will be left behind.

Stock broker : Full service brokers or discount brokers. This will determine the amount of money lost in brokerage fees and the amount of service you will receive. Consider the difference between $1 for a 100 shares of Ford or $10 for commissions. In one case, the commission amounts to about 0.18% in and out while to buy and sell at $10 the commissions will be around 1.8%.

What account size do I need?

This will determine the type of trading you can do. Consider the difference between a $20,000 account and a $100,000 account. Assume the $20,000 account holds 4 positions at $5,000 each while the $100,000 account holds 10 positions at $10,000 each. There is more diversity in the larger account and the cost to buy and sell those stocks will be around 0.2% vs 0.4% when the cost of a round trip is $20.

What number of stocks should I own?

This should be determined based on your account size and risk tolerance. As in the above example, a larger account can be more diversified although you should not get too diversified such that you can no longer manage the stocks you are in. Have you identified how many stocks you are able to monitor and trade at any one time? There was a point in time where I was trading about 50 positions in low priced (<$5) stocks and it was quite difficult to manage them all and keep track of their movements.

Risk management

Your risk management policy should identify what percentage of your account you are willing to risk per trade? In my book, I go through a couple of ideas on this. Typically, risking more than 2% of your account on any one trade would be considered a maximum. I am more comfortable risking 0.5 to 1% of my account per trade. This means that for a $100,000 account I am good with loosing $500 (0.5%) on a trade. Thus, when I buy 1,000 shares at $10.49 I would exit the position at $9.99.

How many shares should you trade?

The number of shares you trade should depend on the risk you want to take. For instance, say you want to buy a $5 stock and there are two exit points that look reasonable. In one case the stop is 20 cents below the buy point while in the other case it is $0.40 below. When you are risking $200 you could buy 1,000 shares in the first case and 500 shares in the 2nd case. When your trade works you will make a lot more with the 1,000 share purchase although your odds of being stopped out are much higher.

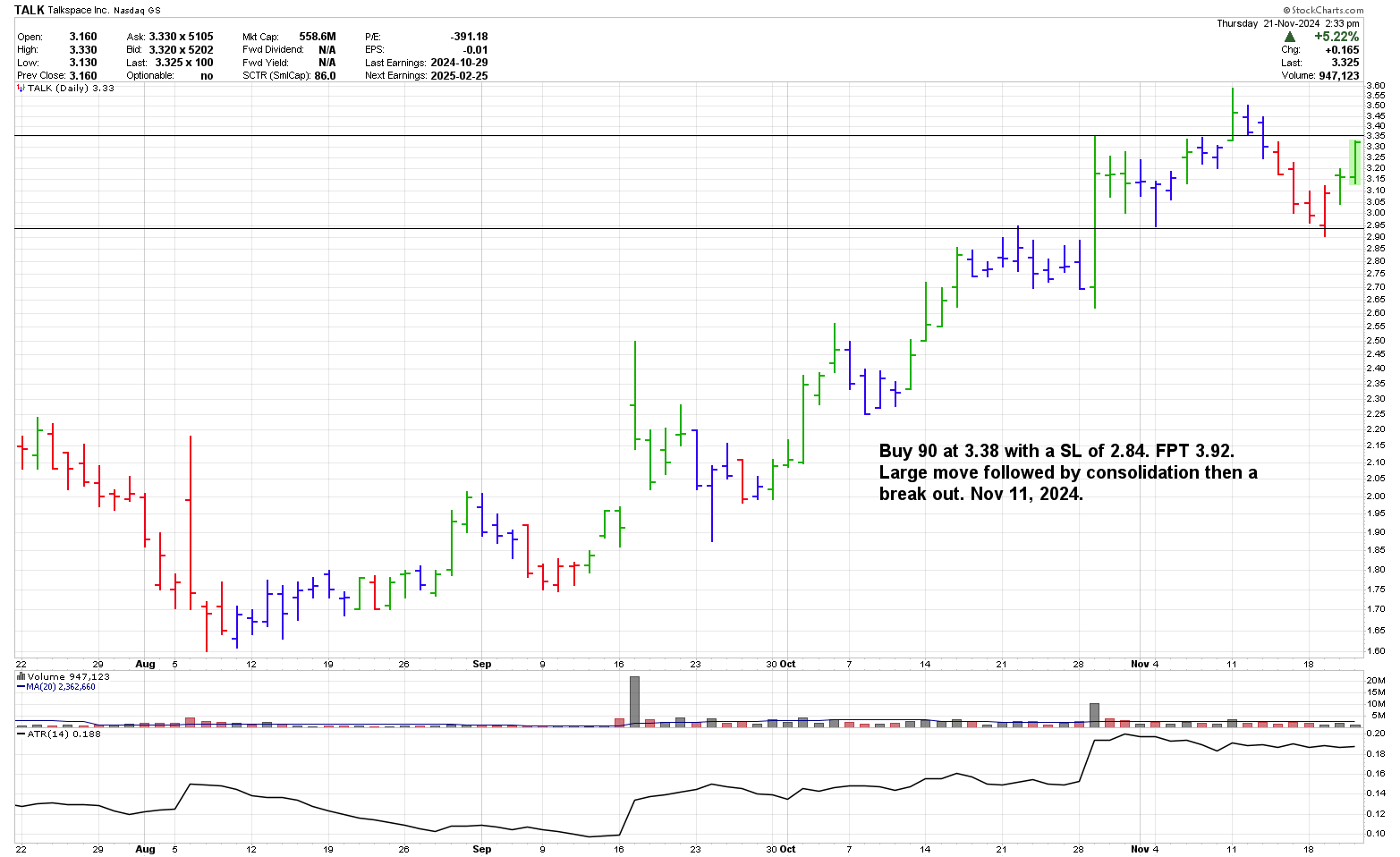

As shown in the chart below, I picked up some shares of TALK on November 11, 2024. My stop was 1 ATR(14) below the low on November 4 at $2.84. Had I put the stop just below the low at 2.93, I would have been stopped out on November 19 when TALK traded down to 2.90.

Before you buy, identify when you should sell if your buying decision was incorrect. This gives you an exit strategy before you buy. Typically exits on logical market data are more useful than a fixed percentage of a move.

Still want to learn more about money and risk management? If you do then you may want to consider reading Alexander Elder's "Come Into My Trading Room" or Van K. Tharp's "Trade Your Way to Financial Freedom". Both of these books offer information on risk and money management.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00