Option Trading Strategies For the Risk Adverse

Many stock traders consider option trading strategies to be risky. This is likely due to the statements found in the media and on the internet which state that over 70 percent of options written expire worthless. However, if you approach them properly, and use the correct strategy, they can, to some extent, reduce the risk of a trade. Like all investment vehicles, there is a time and a place to use option strategies. The two approaches discussed here work well in specific, but not all, situations. Obviously, using options only work on stocks which are optionable.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Option Trading Strategies include buying a call instead of a stock

As a stock trader, it is a good practice to identify where you are going to sell your stock when the trade goes against you. Once you have done this, you have identified the amount of money per share you are willing to lose when you initiate the trade and it goes against you.

Now it may happen that you are stopped out of the trade shortly after you enter the trade or during a subsequent pull back. This is a risk that all stock traders take on, when they initiate a position. To use this option trading strategy, you will be working with this predefined loss and trying to identify if you could buy a call option for the same price or lower which may produce a more favourable risk/reward ratio.

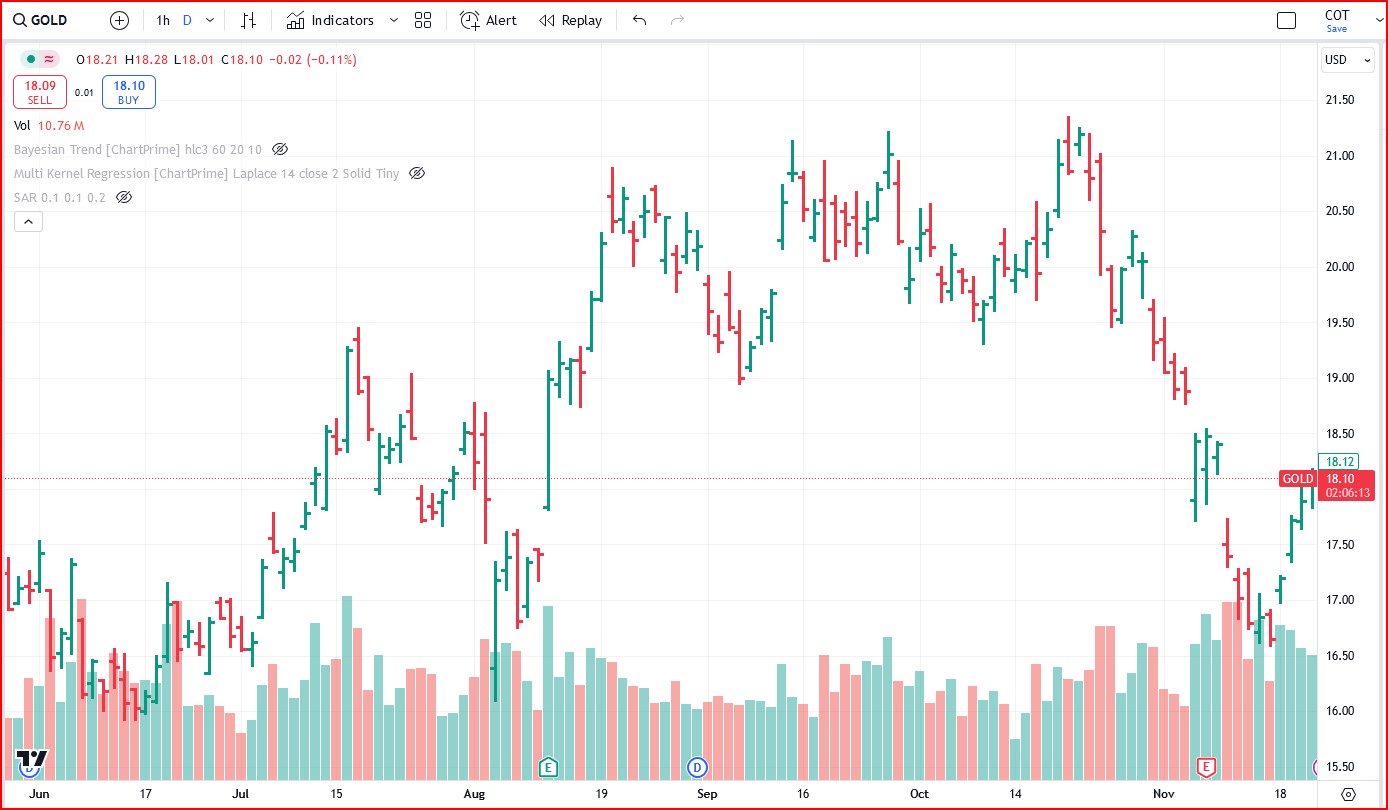

As an example let's look chart of Barrick Gold (GOLD) below on July 3, 2024. On this date, you note that a higher high is forming and decide to purchase the stock. You also see that the $16 area seems to be a reasonable support zone as the stock held that level on three different attempts to go lower. You decide to put your stop at $15.44 which is 1 ATR(14) below the recent lows. Your buy stop is at $17.09 which is 3 cents above the high 9 days ago. Therefore, the risk on the trade is $1.65 or 9.6%. For $500 of risk, you can pick up 300 shares costing $5,127.

You are a bit concerned about this level of risk and decide to look at a call option. Looking at a Dec 20, 2024 $18 call option you see that you can purchase this for about $1.00 which will reduce your risk per 100 shares so you buy 5 calls for $500 which is a lot less than the price of the stock.

Call and put option pricing can be found through most brokers or this information can easily be found on the Barchart website.

Thus, in this situation you have traded the probability of being stopped out for the probability that GOLD will close above $18 by December 20, 2024.

Charts below are courtesy of TradingView

There are multiple ways to play this option:

1. Sell it when you would sell the stock

2. Since it gives you ownership until Dec 20, 2024 hold until a profitable exit comes along

3. Hold it until expiry

Baring the sharp move on Aug 5 there was no real signs of danger here until the stock breaks down in early November. By early October, you notice that GOLD went up to around $21 three times so far and the option price was just over $3.00 so you place a sell limit order at $3.00 which is hit mid-October and you pocket about $1,000 in profits on a $500 risk for a 2:1 reward to risk ratio.

Had you purchased the stock, you would have made (21- 17.09) $3.91 or $1,173 minus commissions for about 23%.

This trade would have produced a RR of 2.34.

This strategy works best for stocks that are trading close to an option strike price thus limiting the amount of intrinsic value in the option price. It is also aimed more at position traders and not short term traders.

Swing Trading Option Idea

For swing traders, high volume and high priced stocks can be traded using their options. As an example, below is a 30-minute chart of the SPY November 29, 2024 option with a strike price of $594 while the SPY was trading around the same range. In this case, on Nov 20, around 15:30, on the break from consolidation, the option could have been purchased for $2.80 with a stop of around $1.80 for $100 of risk per contract.

Once the price broke above $4.20, a stop could have been place there which was hit a f8 bars later. This would have produce around $140 in profits per option contract. This is a relatively easy way to trade expensive stocks.

Caution is required to ensure the option you choose has enough volume. Overnight holds can lead to large losses so make sure you are comfortable losing the cost of the option.

Buying put options in bear markets and selling covered calls are two other option trading strategies which you may want to investigate.

When you are looking at different systems being offered you should try them out for a while, see if they fit your trading style and determine if you are being given good information that will ultimately help you progress as a trader.

You can learn more about options from Investopedia.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00