The Online Stock Trading Game

You against the world

Most people think of online stock trading as only dealing with the buying and selling of stocks and options. This is only part of the game. Before you get to the buying and selling of stocks you need to find the stocks to buy, track the stocks, potentially investigate the companies and chart the stocks.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

To be good at online stock trading, you need to be efficient with your time and use website resources which will help you quickly obtain the information you are seeking.

1. IDENTIFY

First you need to identify a few things. For instance, are you going to trade stocks, options, commodities or currencies. I generally trade stocks and occasionally use options to limit risk. Next, you will need to determine the time frame you will be trading: day trading, swing trading, daily, position trading or investing. Then, you need to identify a trading concept which you will use to develop a trading system. It is this system which will determine the stocks to buy. Whether you are using fundamental or technical analysis you will likely be looking for a stock screener such as StockCharts. When it comes to finding stocks, there are free stock screeners but you can also spend hundreds of dollars per month, it all depends on what you are looking for and how close to the market you want to be.

Another way of identifying stocks to trade is to identify new trends. For instance, cyclical companies that sell energy products, base metals or precious metals may be a good buy if their commodity charts are indicating that a change in commodity pricing is likely to occur.

Other ways to find stocks which may be worth trading are to follow newsletters, stock trading forums or review information provided by stock exchanges. Most newsletters cost $100 to $300 per year with some being free and others costing much more. Forums offered on the web are, for the most part, free to read. Caution is advised here, there are many people writing on forums for their own cause not yours.

Most of the websites that offer stock screeners also offer a stock charting service. After you examine a number of stock charts you should be able to identify high probability chart patterns. Normally, you would then put these into a watch list.

2. TRACK

A watch list is a group of stocks which you can easily access at any time to identify what is happening to the stock and to monitor any news that may move the stock. Two good websites for monitoring stocks are Yahoo finance and MarketWatch. A note here, to enter a watch list, you will need to register with the site. Most websites differ in what they offer so before entering your entire watch list find the website that suits your online stock trading style the best.

3. BUY

Now that you have identified a stock and have some information on it you are ready to place your order. Remember, many consider that the entry into a position is about the least important part of online stock trading.

To purchase a stock, you will need a stock broker that offers online stock trading. A typical full service broker will generally charge between 1 to 2 % per trade. Full service brokers will generally try to offer you advice, tips and try to keep you informed of the general state of the market.

Discount stock brokers can be found that offer freee transactions or charge as little as one dollar per 100 shares or many charge around $10 per trade. Be cautious of services that offer you free trades. They have to make their money somehow. I believe these no fee brokers make their money off of the bid/asked spread. You have to remember though that if you choose a discount stock broker, you will be making all of the trading decisions yourself so ensure that you are comfortable with taking all of the risk associated with self directed accounts. On my stockbroker webpage, I have a number of questions you may want to ask a stock broker prior to sign on with them.

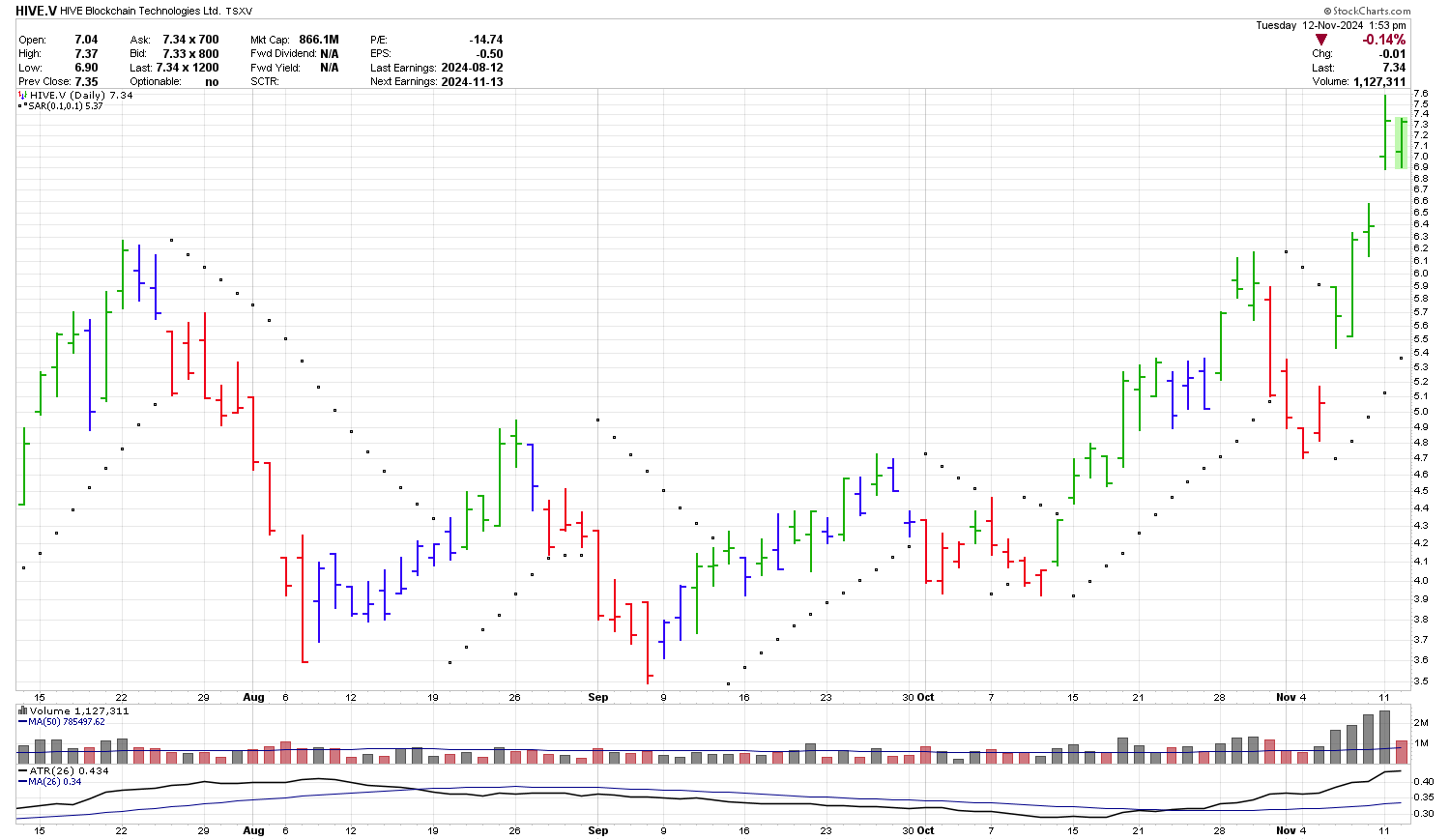

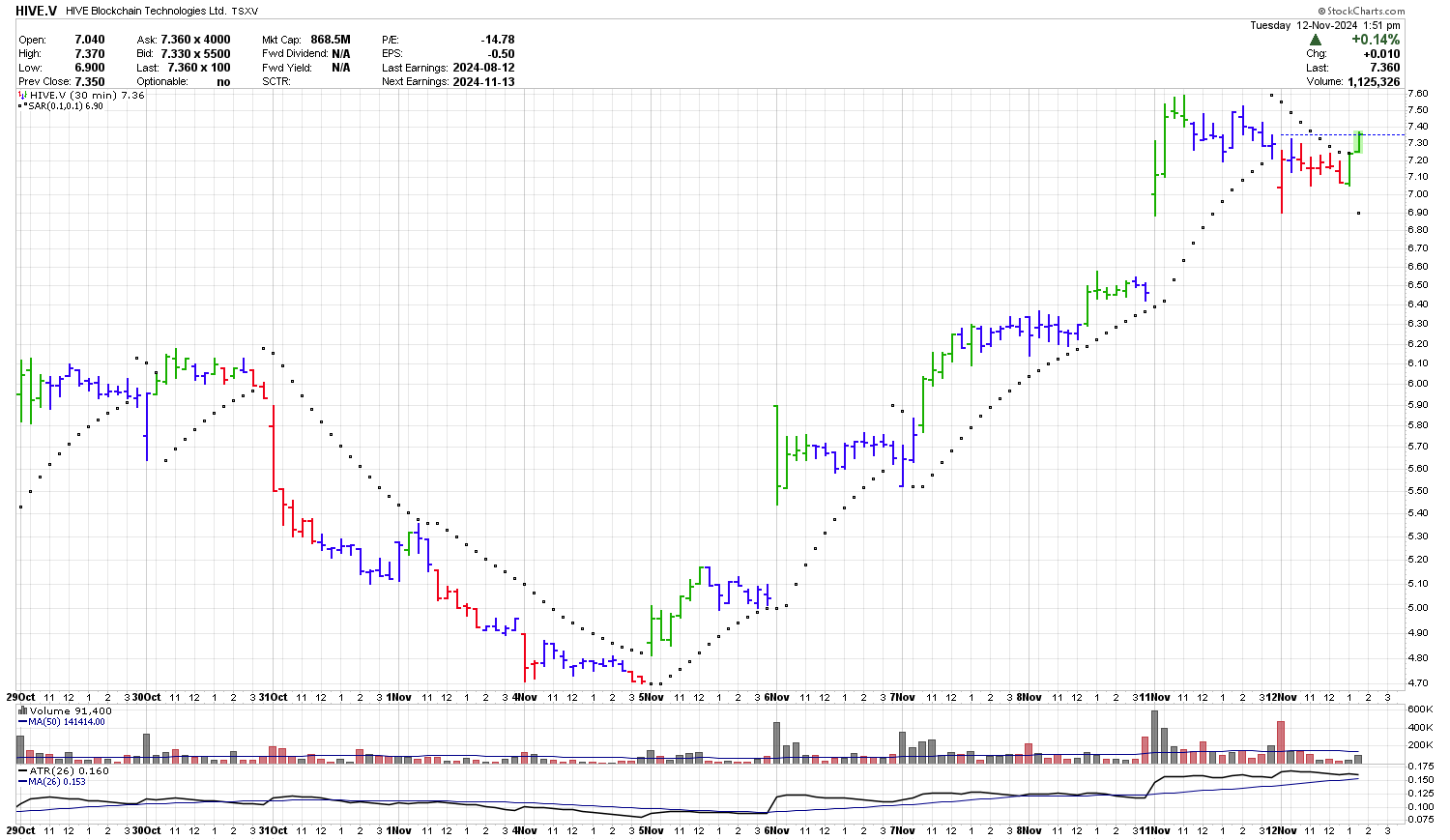

Below are two charts courtesy of StockCharts.com showing a daily and a 30-minute chart of HIVE in the fall of 2024. Which time frame appeals most to you?

4. SELL

After you have purchased your stock, you would generally watch it until you are ready to sell at which time you would go online and close the position.

5. EDUCATION

In order to stay on top of your trading, to test yourself and get new ideas you should spend some of your time reading books, magazines or websites on stock trading. Also, if you have the opportunity to take a short course on the subject this may also enhance your trading techniques. On our review of stock trading websites page, we have identified two good sources which routinely give reviews dealing with the furthering your education trading stocks. Another way to improve your trading skills is to work on the inner game of self improvement. To do this you may want to investigate some of the coaching programs which I have found useful.

Congratulations, you have now entered the world of online stock trading.

Winning at Online Stock Trading

If you are interested in improving your trading skills, take the first step and start to get educated now. Online stock trading is a difficult game.

Learn what this professional stock trader has to say if you want to start understanding the stock market.

Once you think you deserve a little reward for your efforts consider picking yourself up some gifts for stock traders.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Short Course

Introduction on How to Trade Stocks for Beginning Traders

New to trading, not sure where to start. I have put together a short course consisting of 18 lessons. Each lesson should take less than 5 minutes to review. Each lesson provides you with alternate resources to continue learning about that particular topic.

To learn more about this course and sign up please visit the course webpage by clicking the link below.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00