Explain Option Trading

The Need to Understand Puts and Calls

Stock Options

Stock options consist of puts and calls. To explain option trading, you need to know the difference between these two vehicles. A put gives you the right to sell a stock at a specific price for a specific time period while a call gives you the right to buy a stock at a specific price for a specific time period.

Buying a put is similar to shorting a stock which is an action taken in a bearish market while buying a call is similar to buying a stock which is an action taken in a bullish market.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

The big difference between stocks and options is that generally, unless a company goes bankrupt, you can trade a stock for an indefinite period into the future. However, most stock options are good for a maximum of 9 months.

LEAPS can be purchased which have a maximum expiry date of close to around 2 to sometimes 3 years but for the sake of this article, only options will be discussed. Both daily and weekly options can now be traded as well.

Weekly options start to trade on Thursday and expire the following Friday. These short term options are a favourite of traders who day and swing trade expensive stocks.

Explain Option Trading

To explain option trading properly, you need to know that the cost of an option is mainly dependent on three factors – distance to the strike price, time to expiration and market volatility.

The price of puts and calls go in the opposite direction. For example, if a stock is trading at $30 a $20 put will likely be going for pennies as the likelihood that the price will drop to below $20 by expiration is low. However, the $20 call should be priced above $10 as the call has $10 of intrinsic value attached to it.

Let’s look at an example.

Option Trading Example

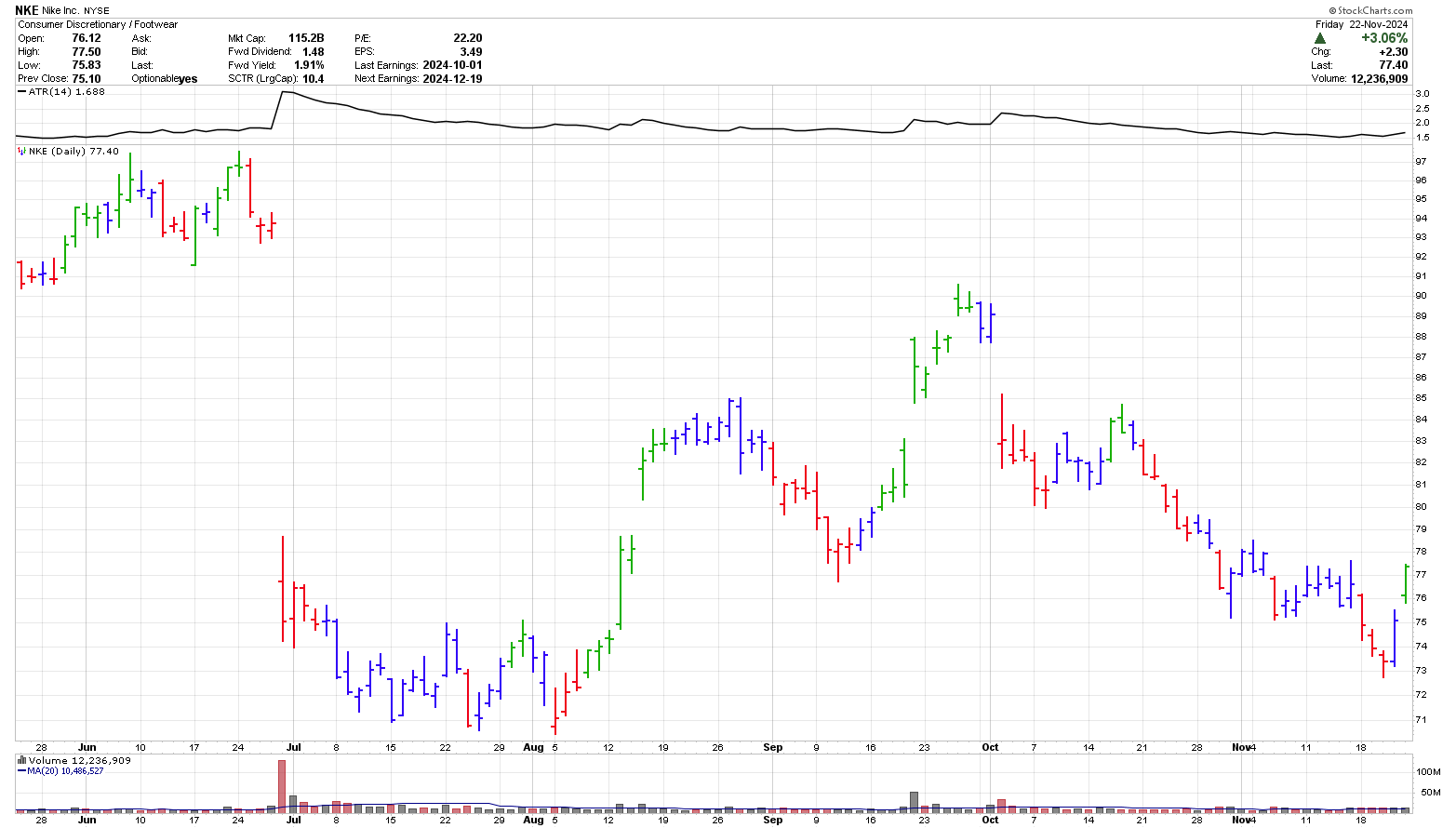

Consider the following. You are following Nike (NKE) and see that based on the large up move on November 22, 2024 it appears to be turning around. You decide to buy it on Monday at the closing price of $77.40 with a a stop of $70.99. The stop is one ATR(14) below the low of $72.71 which is $71.02 so you go with $70.99 to be below an significant area. The risk on the trade is $6.41 or 8.3%.

You decide you don't want that much risk so you look at the February 21, 2025 calls. These calls will give you 92 days of time value before they expire. You expect that NKE can regain about 50% of the recent down move or around $9 and set a target of $81 and expect the move to take 2 months so the Feb call should have an extra month of time that can either be sold or used in case NKE does not move as fast as you expect.

Chart courtesy of StockCharts.com

Looking at the call options, the $75 call was last traded at $5.75 while the $77.50 call was last traded at $4.00. You decide to risk $800 and buy two of the Feb 21, 2025 $77.50 calls.

Up to the expiry date, the call option would give you the right to buy shares of NKE from the seller of your call option for $77.50 which you could do, provided the stock was above $77.50. When NKE closed below $77.50 on the expiry date then your call option would be worthless.

Alternately, you can just sell the call option, prior to expiration date, when you want to exit the trade.

One way to get a basic understanding of what to expect in the future is to look at a lower priced call now and extrapolate into the future. For instance, since NKE closed at 77.40 on Friday, the February 21, 2025 72.50 call might be priced similarly to 77.50 call when NKE is at 81. The 72.50 call was last traded at $6.60 so you might expect your 77.50 call to be worth around $6.60 when NKE trades at $81.

Alternately, you can look at the delta of the option which is the size of move made for a 1$ move in NKE. In this case, the delta is 0.47 so when NKE moves 4$ the option should move around $2.00. As the price of NKE increases, the delta of the 77.50 option will also increase. It will likely approach 0.80 when NKE gains $10 to 87.50.

The above two methods will give you an idea of what to expect as NKE approaches $81.

To explain option trading further it may be helpful to learn about option trading strategies. These strategies may help us explain option trading to you such that you have a better understanding of option trading.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00