Covered calls are a relatively risk free way of increasing your returns

Writing covered calls on optionable stocks you have purchased may be just the option trading strategy you are looking for to increase your annualized return. When you sell calls against your optionable stock it is your choice which call you sell. Building a portfolio of optionable high quality stocks is a good way to have a source of reoccurring income and when done properly may be more desirable than buying bonds. This is one way to create residual income for yourself.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

The Covered Call Option Trading Game

Not all stocks are optionable, however there are many websites which identify the ones that are. By writing a covered call you are reducing your downside risk at the expense of your upside gain.

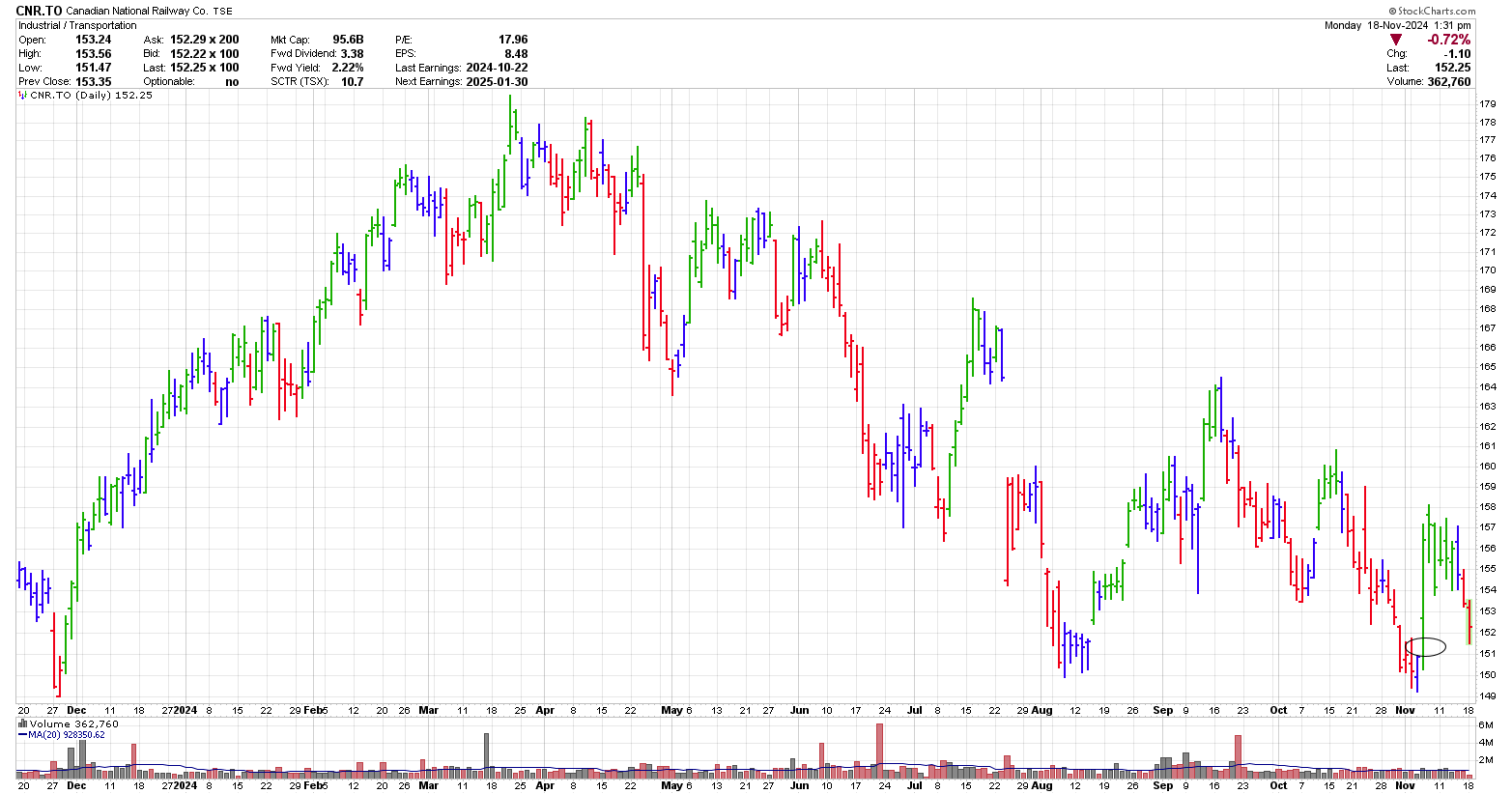

For example, on Nov 6, 2024 I purchased 100 shares of CNR (Canadian National Railroad) at $151.61 as a long term hold for dividend growth and capital appreciation. On Nov 18, 2024, I sold 1 February $160 call for $2.65 which incurred $11.24 in commissions. Provided CNR stays below $160 on February 21, 2025 I will keep the $253.76 and the stock. When CNR is above $160, I will receive $160 for the stock minus commissions. The call premium I received is equivalent to approximately 6.7% yearly return. I also continue to receive the dividend payment.

Depending on the closing price of CNR on Feb 21, 2025 will determine my path forward. When the stock is "called" away in February due to the price being above $160, this trade will have netted me approximately $11.75 per share or around 8.7% for a 3 month hold. Pretty good by my standards.

Increased Downside with Limited Upside

By selling a covered call against CNR, I have reduced my downside exposure by $253 and limited my upside potential to 162.53 (160 + 2.53) per share. Also, if I still own the stock at the end of trading on Feb 21, 2025 I am free to sell another call against the stock and repeat the process.

The premium you receive for your stock is mainly dependent on the amount of time value left in the call, the strike price, the perceived volatility of the stock and current stock market sentiment. As the premium varies among stocks, some stocks are more suited to writing covered calls than others.

It is a good idea not to initiate this strategy on a stock that

is in a downtrend or appears to be bearish. It is a great strategy for long term holds. In the case of CNR, I picked it up on a divergence signal and decided after the fact to do a covered call on it. A better option would have been to monitor the price after purchase and sell the option at the first sign of weakness. This would have provided me with a higher call premium or a similar premium with a higher strike price.

Dividends

As CNR pays a dividend, you may be wondering who gets the dividend after I wrote the call against the stock. As long as I own the stock I will receive the dividend. In some cases, the buyer may call the stock away from you just prior to the dividend date such that they can receive the dividend.

To understand a bit more about covered calls you need to know about call options.

The Long Game Covered Call Strategy

For investors who like the idea of buying stocks in growing companies and are concerned about the low yields provided by higher growth companies consider the difference between CNR.TO and BCE.TO (Bell Canada). On Nov 18, 2024, CNR was paying a dividend of 2.2% while BCE was paying 10.4%. For a dividend lover, BCE seems to be the stock to buy. However, consider the comparison of these two companies shown in the graph below. Since mid 2016, BCE has gone nowhere in price while CNR has increased about 140%.

When you are concerned about the low dividend given by CNR just sell a few shares to make up for the difference in income. Alternately, sell out of the money calls on CNR. From the graph, CNR increases about 16% per year or 4% every 3 months or 5.3% every 4 months. This is an average. Some months it goes up more than this and others it drops.

At the current price of around $152 that means roughly it will go up somewhere between 6 to 8$ over the next 3 to 4 month. Therefore, to be safe, sell the $165 March calls which are $13 out of the money for around $1.70. Over a year, this will add approximately $500 of income into your bank account for every 100 shares you own. In the unlikely event that the stock gets called away, just put a buy into the market and buy the stock back when the price drops down as it seems to do on a relatively frequent basis.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Short Course

Introduction on How to Trade Stocks for Beginning Traders

New to trading, not sure where to start. I have put together a short course consisting of 18 lessons. Each lesson should take less than 5 minutes to review. Each lesson provides you with alternate resources to continue learning about that particular topic.

To learn more about this course and sign up please visit the course webpage by clicking the link below.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00