Dating the Market

Dating the market is how I like to consider stock trading.

I don't want to marry my stocks. Stock trading seems so simple. Find a stock, click buy and wait. Later, click sell and money is deposited into your account. Perhaps you do this a few more times with success. With each win you become more convinced that you are in sync with the market, never realizing that you just got lucky. Then one day, when you least expect it, the eventual loss comes followed by another and before you know it you have given all your winnings back, and then some. What once seemed simple is now frustratingly difficult.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Dating the Market

Are you tired of giving your hard-earned money to other traders? Have you asked yourself, why can’t I figure this out? Do you want to take your trading to the next level?

In Dating the Stock Market, you will learn that your mindset towards the markets and yourself can make all the difference to your success. This is useful information as you cannot change the markets, you can only change your interaction with the market. Once you realize that the gap between loosing and making money in the financial markets is within your control, you have taken a step towards becoming a consistently successful trader.

A summary of my book can be found in the September 2020 issue of the magazine Technical Analysis of Stocks & Commodities on page 62.

To give you an idea of what is in the book - Dating the Stock Market, check out these charts, graphs and tables, This will give you an idea of what my trading strategy while writing the book.

Book Bonuses

To take a look at the bonuses offered in the book click here.

These three bonuses are:

1. Daily Break from Consolidation Trading Plan

2. 12+ Reasons Why Backtesting Cannot Work and Why You Need to do it

3. Benefits and Disadvantages of Weekly Trading Strategies

You will also find Table 1.1 on this page. For some reason, a truncated version of Table 1.1 ended up in the book.

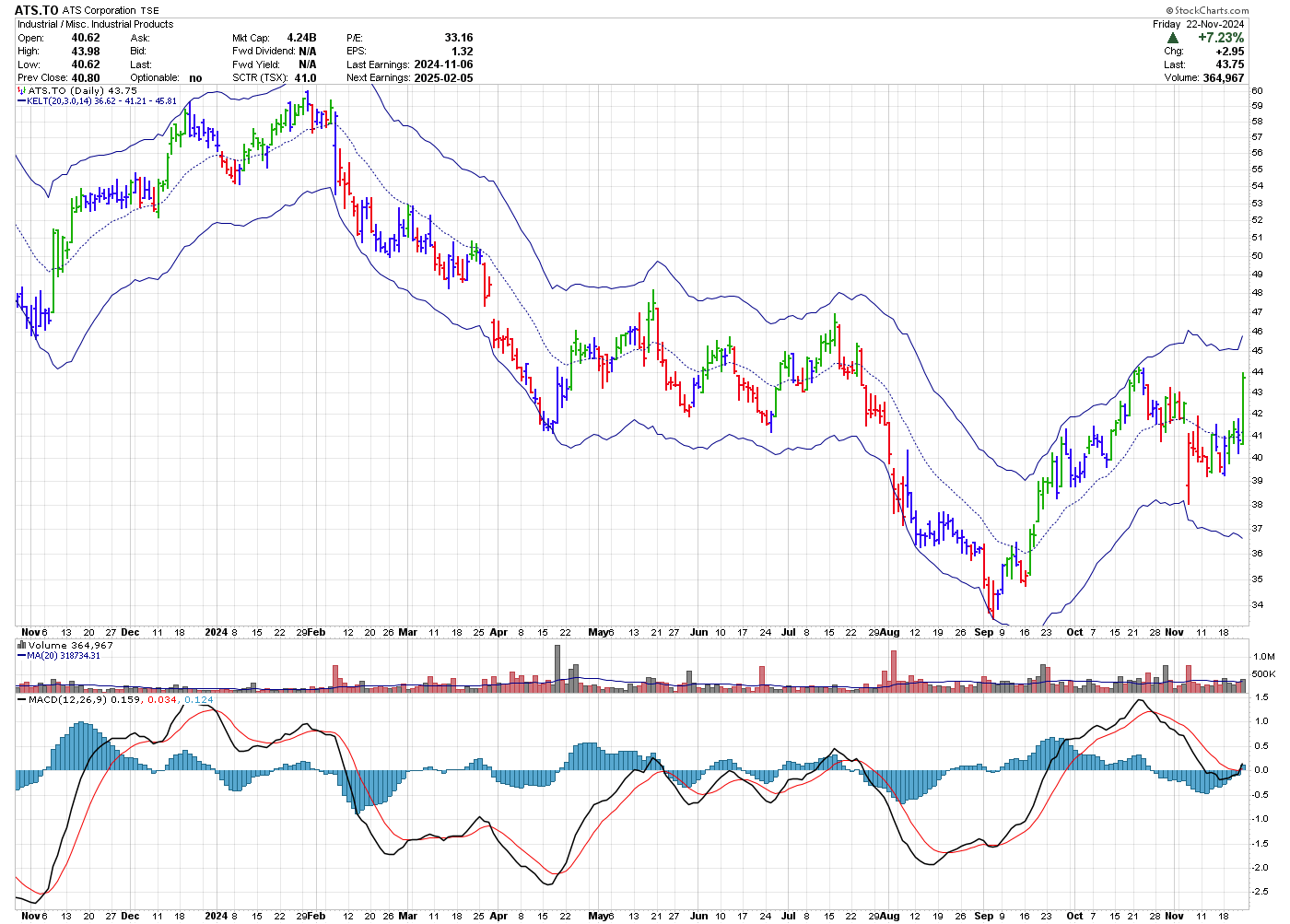

Stock chart courtesy of StockCharts.com

Do you have a plan that would allow you to trade a stock?

Learn Why Dating the Market is better than Marrying the Market

Your job as a trader is to become a consistently successful trader. To do that you need to work with the market, not against it. You must ensure a loss from one trade does not contribute to further losses. You need to develop a winner’s mindset and improve your trading psychology.

Dating the Stock Market identifies 10 key areas you need to be aware of as you begin your journey towards understanding the markets and yourself. You will uncover why you need a consistent approach when entering the unpredictable financial markets. By understanding how to use your edge, in combination with money management, to get into and out of the markets you will begin to see how you can get to the next level.

In the midst of market uncertainty, prior to entering a trade, you need to quantify how much you are willing to risk to achieve a potential reward, the probability that you will be right and where you will exit the trade, when proven wrong. To help you with this, Monte Carlo simulations are used.

This book uses a dating analogy to align the emotions and feelings experienced when dating to those encountered by a trader such that you can use internal references to deal with the challenges of trading. Start your journey towards becoming a consistently successful trader today by reading Dating the Stock Market.

Testimonial

“As a great student of the market, Mark Kelly has learned what so many traders forget. To be a great trader requires you not think and act like every other trader. His book is an asset to any trader wanting to be a better trader.”

Tyler Bollhorn- Author of the Mindless Investor and Perspectives on the Stock Market, Founder of Stockscores.com

Chapters in the book - Dating the Stock Market - 10 Key Mindsets You Need to Excel as a Trader

Chapter 1: “Creation Versus Consumption”

The mind used to create a plan is not the mind you use to trade

Chapter 2: “The Need for Consistency”

Describes why the trader who does the right things consistently will become successful

Chapter 3: “Surviving a Loss”

Details why a trading loss is just a loss and says nothing about you as a person

Chapter 4: “Is It the Market or You?”

Identifies multiple ways the market can change direction leading to a loss versus trading errors

Chapter 5: “The Winning Percentage”

Identifies the winning percentage you need and how many losses in a row you can handle

Chapter 6: “Are You a Base or Home Run Hitter?”

What constitutes a winning trade and why you should consider scaling out of trades

Chapter 7: “Balancing Short and Long-Term Objectives”

Using Monte Carlo simulations to demonstrate the variability of a trading plan

Chapter 8: “Dating the Stock Market”

How to define your risk and profit targets before you enter the trade

Chapter 9: “Your Trading Plan”

Parts of a trading plan and how to write one – example provided

Chapter 10: “Putting It All Together with a Working Trading Plan”

Designing a logical system and a review of actual trades

Chapter 11: “Epilogue”

Trading the stock market is a probability game, learn to think in probabilities.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00