Stock Trading Exit Strategy

You should know your stock trading exit strategy before you buy a stock. This simple money management strategy can limit losses and save you from having a large loss when your trade goes against you.

A stock trading exit strategy is easier to set before you buy a stock than after you buy

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

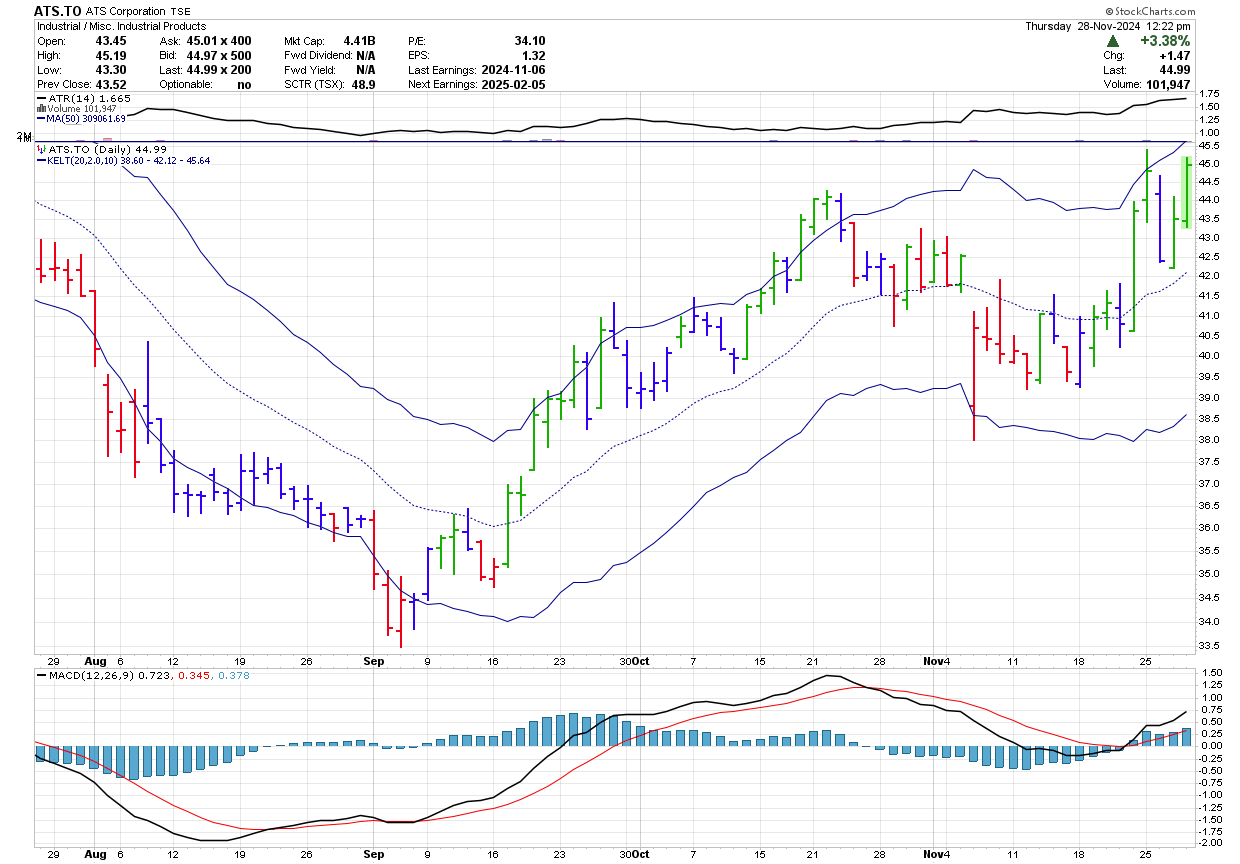

Lets look at the following example. Below is a 4 month stock chart of AST.TO. in early September 2024, a divergence formed between price and the MACD line and histogram suggesting that even though a new low had formed, based on those indicators, the stock was stronger than it was previously. Think of it this way, the stock is dropping at a slower rate than before.

Knowing this, you wait for an entry. Prior to September 17, you note that a higher high will be formed once the high takes out the high on September 12 and you decide to place a buy on stop order into the market.

Next you need to identify where you want to get out when the stock goes against you. You only want to risk $500 on this trade. There are likely multiple exit points you could use. Your exit strategy will determine which one you choose.

The market has identified two obvious spots where a stop could be placed. These would be just under the lows of September 5 and 16. For the sake of this discussion lets go with 5 cents below these lows as well as one ATR(14) [$1.00] away from the lows. From a slightly different perspective also consider 3 ATR(14) away from the stop price of $35.61.

Therefore, the potential exits are:

From the low on Sept 16: 34.68 (risking $1.83) or 33.73 (risking $2.78)

From the low on Sept 5: 33.42 (risking $3.09) or 32.47 (risking $4.04)

Three ATR(14) [$1.00] away from the buy point of 36.51 or 33.51 (risking $3.00).

The tighter your stop, the more shares you can buy without risking more. You need to decide where you will put your initial stop. Once it is set, only move it upwards as the stock moves up. Never move your sell stop downwards.

Chart courtesy of StockCharts.com

Now to figure out the number of shares you will purchase, take $500 and divide it by the risk per trade. Taking on the least risk with the highest probability of the stop being hit is the closest exit of $34.68. With this exit, you can purchase 273 shares while the trade with the most risk and the lowest probability of the stop being hit can purchase 123 shares.

As you plan on doing a lot of trading you decide that it is best to take the one with the least risk as in the end you believe you will make more money. Also, with more shares you are in a better position to have an exit strategy which can participate in unexpected moves to the upside. It will also allow you to scale out of the trade.

In the end you buy 270 shares at $33.51 with a stop at $34.68 and risk $1.83 per share.

According to Van Tharp, in his book Trade Your Way to Financial Freedom (1st edition) scaling out of a trade generally will make less profits, over the long run, vs a system that just sells when the market indicates a sell is required. While making less money, it should have a higher win rate.

In the above section, five different prices were identified for your exit strategy.

Now, let's look at exit strategies for profits.

Exit Strategy for Profits - Scaling Out

Once you are into a trade you need an exit plan. Are you going to scale out of the trade, buy more as the trade goes in your favour or are you going to sell when the market sends you a signal.

A signal from the market will be determined by you and could include ideas such as: moving average cross over, a lower low, a trendline break or some other indicator or perhaps based on time.

In many cases, one of the most difficult aspects of trading is to determine at what point should you be selling the stock.

As you are risking $1.83 per share and want to get to break even as soon as possible, you decide to sell 1/3 of your position at a price which will get you to break even. You therefore enter a sell limit order at $42.00 which is hit on October 15. As the stock moves higher, you place your stop 5 cents below the low of Oct 11 and are taken out of the trade unexpectidly at $38.79 when the stock opens lower after the US Presidential election.

Generally, the closer your stop loss sell point is to the market, the higher the probability that you will get stopped out. So when you set your sell stop, it should be at a place where strength has appeared in the past.

Selling at a high point will typically make you more money in the short term but may not in the long term.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00