Free Bonus from Dating the Stock Market

Free Bonus #1 - Daily Break from Consolidation Trading Plan

A trading plan acts as a guide to how you are going to interact with the

markets. In this free bonus, an example of how a trading plan can be written

is provided. It gives a working example of a trading plan as was

discussed on page 121 in Section 9.3 “Your Trading Plan” in my book Dating the Stock Market.

From the information presented in this trading plan, a trader should be

able to devise a way to enter the market which will give them an edge

and write their own plan around this edge. Bonus #1 - get your trading plan here.

BONUS 2 – 12+ Reasons Why Backtesting Cannot Work and Why You Need to do it

Backtesting

is used to quantify how good your edge is. Backtesting reviews

historical data and uses the written software code to buy and sell

stocks according to your trading plan. It is a quick way to

differentiate between a good and a poor system. Once you understand that

your edge is valid, you can start to trade it with a small amount of

capital. As you go forward, you can compare your results to how the

computer would play the same set up and see how well you are handling

live trading. In this free bonus, the presentation outlines many of the issues with

backtesting yet still recommends doing it. Find out why backtesting does not work and yet you still need to do it.

BONUS 3 – Benefits and Disadvantages of Weekly Trading Strategies

Whether you work full time during the trading day, find yourself too busy during the day or don’t have the patience to watch the computer screen you may find trading using weekly charts just what you are looking for. Weekly charts provide a way to trade on a longer-term timescale and still carry on your day-to-day business. When I trade using weekly charts, I typically do the analysis on the weekend and enter my trades using bracket orders on Monday morning. Monitoring and adjusting my trades typically take between 0 to 30 minutes per day. For this free bonus, learn how weekly trading strategies can help you?

Testimonial

“As an expert in the field of investing in Real Estate I attribute my success to a change of mindset and beliefs which I now teach to my students. As a student of Real Estate Investing I have witnessed first hand how Mark has changed his mindset and beliefs about real estate and how he is now applying these lessons to his own area of personal expertise, the stock market. Dating the Stock Market is an educational source for traders who want to identify ways they can make changes to their mindset which can help them become better traders.”

Ken Beaton- President ARCA Real Estate Investments Inc., Broker, EXP Realty of Canada Inc.

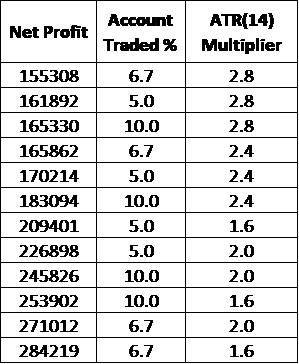

In the published book, the first Table (Table 1.1) was uploaded incorrectly. The table has been reproduced below.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Short Course

Introduction on How to Trade Stocks for Beginning Traders

New to trading, not sure where to start. I have put together a short course consisting of 18 lessons. Each lesson should take less than 5 minutes to review. Each lesson provides you with alternate resources to continue learning about that particular topic.

To learn more about this course and sign up please visit the course webpage by clicking the link below.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00