Mark Douglas and Trader Psychology

Pressed for time I asked a friend which of the two books Mark Douglas wrote, I should read first, The Disciplined Trader written in 1990 or his second book Trading in the Zone written 10 years later in 2000.

He felt that everything in The Disciplined Trader was in Trading in the Zone so he recommended that one. After I read Trading in the Zone, I read The Disciplined Trader four months later. I think he made the right choice on which book to read first however, I do not think the books are very similar and am glad I read them both.

Trading in the Zone Mark Douglas

Reading Trading in the Zone

caused shivers to go through me as there are a lot of really interesting

comments, suggestions and one great exercise. Mark summarizes his

thoughts into five fundamental truths of the market.

Mark Douglas - 5 Fundamental Truths

1. Anything can happen.

2. You don’t need to know what is going to happen next to make money.

3. There is a random distribution between wins and losses for any given set of variables that define an edge.

4. An edge is nothing more than an indication of a higher probability of one thing happening over another.

5. Every moment in the market is unique.

This last point is quite interesting when you think about it. You have no idea when you enter a trade who is in the market at that time. You don't know what they are thinking or what they want. You also don't know what will happen.

A major world event could happen, the leader of a country could make a really stupid decision, the CFO of the company you just bought could decide to retire or any of hundreds of unknown events could happen. And there isn't a thing you can do about any of them, except get out of your position when it goes against you.

So your set up was good and the trade did not work, that happens. There is no system on the planet that works 100% of the time.

When you build a trading system, back test it, know how it is suppose to perform (at least in theory), know that it is profitable over a given number of trades and know what to expect.

Once you understand your system and think you can follow it, then you are ready to begin an exercise that Mark Douglas outlines in the final chapter of Trading in the Zone.

Here is the basis of the Mark Douglas exercise:

- Pick a market

- Choose a strategy to enter the market and determine how you will exit the market

- You must take the next 20 trades your system gives you without deviating from your system

As you begin to do this exercise, all of your inner demons, which do not like rigidity, will start to show. You will start to think about changing your system, adding parameters, skipping trades because of something you heard or become fearful due to a development somewhere in the world.

I started this exercise on March 1, 2013. This is the 2nd time I have started the exercise. The first time I didn't get very far. The second time, I completed 20 trade exercise and lost a few hundred dollars. I gained many valuable lessons from the exercise. The first one was I was capable of doing it, some trades worked out and others did not. I could have broken even except I did not take a trade due to earnings.

To learn more about this exercise you can visit Paula Webb's website. She collaborated with Mark in many areas. On this website are more detailed instructions regarding the 20 trade exercise. Unfortunately, Mark passed away on September 12, 2015 at the age of 67.

Based on the further explanation regarding the 20 trade exercise I made two errors. First I only did the 20 trade exercise once and I traded multiple stocks when doing it. I knew they wanted the exercise done with only 1 vehicle (an actively traded stock or future) however, I reasoned that it would take me years to complete the exercise when I did this as I did not do short term trading at the time.

When you learn more by hearing and watching, you can check out this Mark Douglas YouTube video

interview. He does not go over the above exercise during this interview however, you will get a good idea on his thought process.

https://www.youtube.com/watch?v=GhKJ9P3agRc

By June 2, 2013, I had entered a total of 16 trades. Most unfortunately, were losers. I have determined that the system does not trade as frequently as I would like. This is important, as to frame a phrase from Robert Kiyosaki, "the velocity of money" the harder your money works for you the better off you will be. On reviewing historical trades, the system wins over time however it is heavily based on how I handle the big winners. Thus, if for some reason I do not take a specific trade and it turns out to be a 10 times risk winner then the system starts to break down.

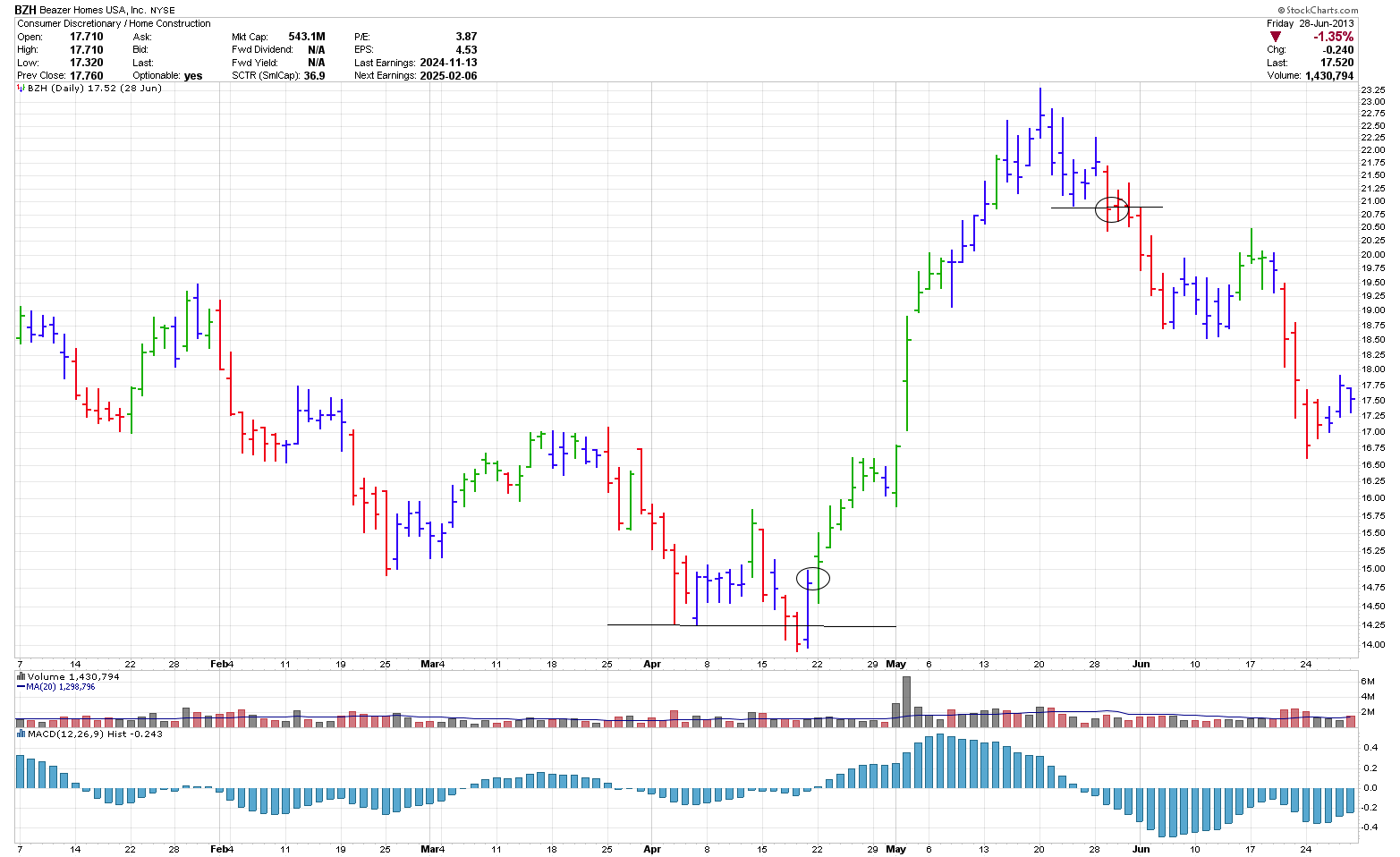

In the 2nd test, I did not take BZH on April 19,

2013 at $14.82 because earnings were reported to be in less than 10 days

and I had a rule going into these trades that I was not to enter a

position within 2 weeks of earnings. In this case, the stock advanced

to $23.29 and I would have gotten out of the position at $20.69 on May 29.

Another weakness of the system I was using at the time, was it looked for trend

reversals after a double bottom as shown in the stock chart of BHZ above. These

have high payouts when right however, frequently the signals are false.

From reading Alexander Elder's book, "The New Trading for a Living" he

details a way to use the MACD histogram as a way to identify divergence

between price and the indicator. It to does not work all of the time

however, it potentially can reduce the number of signals a trader would

take. For the BHZ trade, there was a MACD histogram divergence.

I now use AmiBroker to carry out backtesting to more fully explore the concepts I am using to see exactly what type of an edge I have with this type of system.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00