Risk Management

Determine your exit price before you trade

A risk management plan should be put in place before you enter a trade not after. Have you thought about everything that could happen to the trade before you buy? Would you step off a cliff without looking? Likewise, you should not blindly enter a trade. Prepare your risk management plan before you enter the trade.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Risk Management in Trading Can Help Grow Your Account

Remember it is a lot easier to identify when you will get out of the market before you buy into a position than after your own a stock.

What percentage of your account are you willing to risk per trade?

As a general rule of thumb in the industry, stock traders should risk a maximum of 2% of their account per trade. Many would suggest you risk less. I typically risk 0.5 to 1%.

What does this mean, 2% of your account? It means that when you have a $10,000 trading account, you can only risk $200 per trade (10,000 x 2/100) per trade.

As a risk management example, when you buy 100 shares of a $28 stock you would have to sell it if it dropped below $26. However, if you bought 200 shares of the same stock you would sell below $27. In trading though, an arbitrary price makes no sense. The price you choose should be related to market activity.

How much can you lose and still sleep at night?

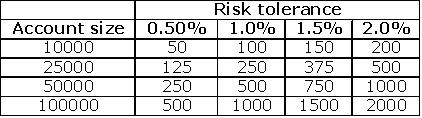

Let's look at the table below. It gives a number of different account sizes and 4 levels of risk, 0.5%, 1%, 1.5% and 2%. Thus, when you have a $25,000 account and only wanted to risk 1.5% of your account on each trade, the most you should lose on any one trade would be $375.

Can you sleep at night knowing that you have $200 on the line? Would you be a better trader if you only risked $100? Only you know the answer. One of the main issues when trading is that traders put on too much risk, get scared and then don't follow their trading plan.

Traders generally need time to work their loss acceptance amounts up. For instance, when you are new to trading and have a $10,000 account, loosing $200 on one trade may seem like a lot of money to risk. When this is true for you, drop down to the $50 or $100 level until you feel comfortable risking this much per trade. Only increase your level of risk once you become comfortable.

Another risk management strategy talked about by Alexander Elder in his book “Come Into my Trading Room” is the 6% rule. This rule is meant to protect your overall trading account from major losses. He states that at any one time you should not have more than 6% of your trading account at risk. Basically, if you buy three stocks at 2% risk each, you cannot buy any more stocks until these first 3 stocks move up and you have moved your stops up. This book contains more information on risk management and a brief description of it can be read in our technical analysis book section.

To protect your trading account, you should not go beyond the 2% per trade or the 6% total risk limits.

Risk Management Examples

Many may ask, why risk management is Important in trading? Let's examine a potential trade in an attempt to look at some of the issues that complicate the risk management philosophy you use.

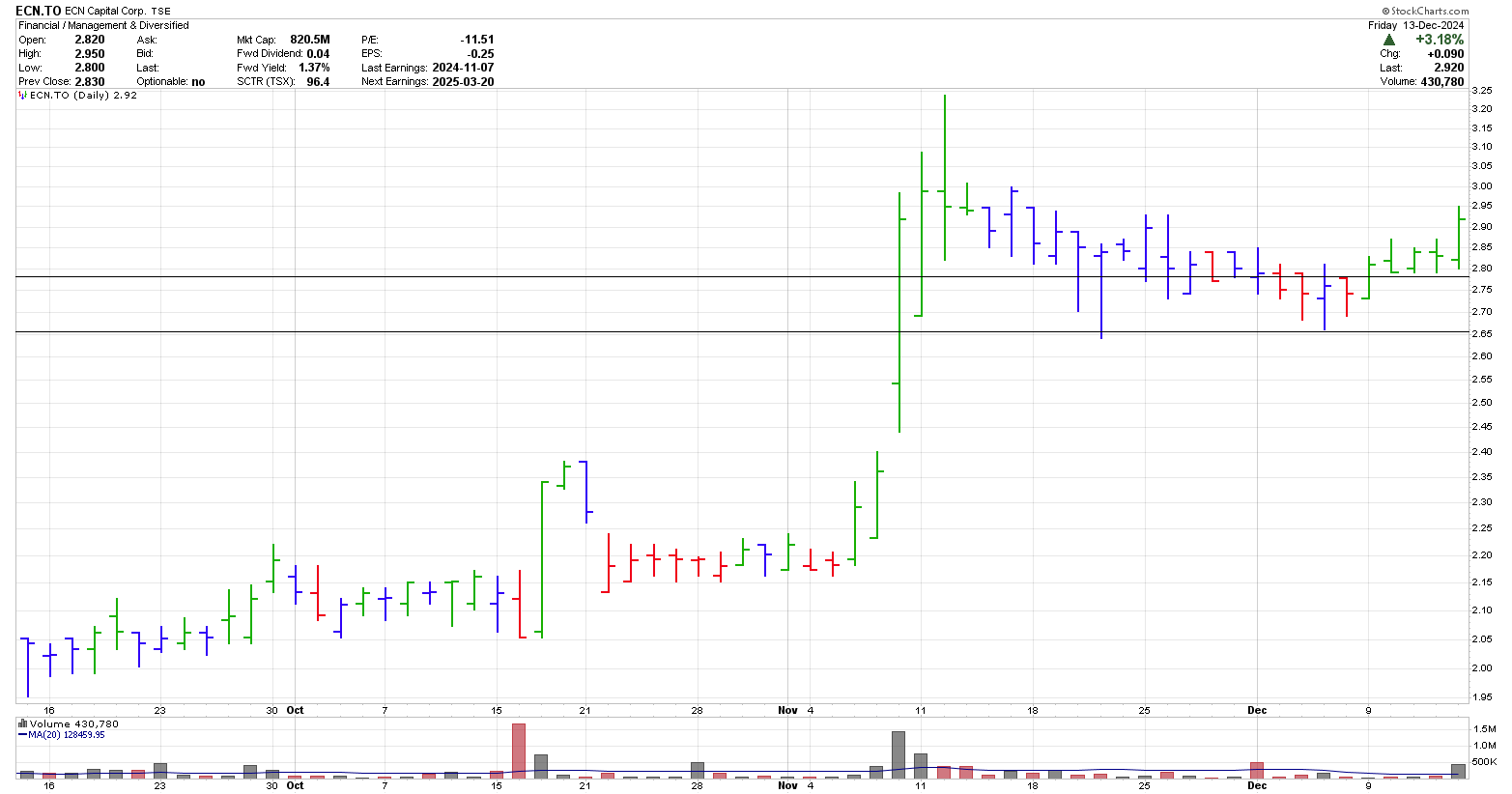

ECN.TO is traded on the Toronto Stock Exchange. On Friday December 13, 2024 there was a potential breakout which was accompanied by higher volume.

The trader sees the breakout after the close on Friday. These are all the options which are apparent:

- Buy the open Monday morning - possibly $2.92 or where the market opens

- Buy 1 to 3 cents above the high of Friday ($2.96 - $2.98)

- Place a limit order at $2.88 in an attempt to get better cost position

Now consider the stop loss points:

- The low of the three-day consolidation is $2.79

- The low on December 5, was $2.66.

The 14 day average true range is $0.12. With this information, one could reasonably suggest that the stop loss point should be anywhere from $2.78 down to $2.54. As you can see, this is a large range.

The minimum risk would be to buy the open with a stop loss below the previous 3-day consolidation at $2.78. This puts the risk on the trade at $0.14. Assumes a $2.92 open.

On the other hand, the maximum risk that one could take on this trade would be $0.44. From a dollar perspective, when one is risking $200 on this trade, approximately 1,400 shares could be purchased when the risk is $0.14 per share. This would drop down to approximately 450 shares when $0.44 is used as the risk.

From the above discussion you can see why risk management is important in trading. I think in the larger risk, there is a higher probability that the trader will not be stopped out by some fluctuation in market price. On the other hand, one could argue that when this is truly a breakout, price should not go back below the three day consolidation previous to the breakout.

This is where previous backtesting of this type of setup would lead the trader towards a certain exit point. Once the backtesting shows one particular method is the preferred method, then that exit strategy would be the one the trader consistently uses.

When you are interested in improving your trading results, take the

first step and start to get educated now. Risk management is one of the

key areas you need to learn about before you can trade successfully.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00