What type of Stock Broker should I use?

Stock trading fees can make the difference between

a winning and a losing trade

The stock broker you use will determine the amount of money lost in brokerage fees.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Trading commissions are a necessary evil that are charged by all stockbrokers. Generally, in order to buy and sell a stock you will require a brokerage firm and they all charge something for the privilege of buying or selling a stock for you.

True, you can now get commission free trades. However, ask yourself how will the broker make money when they don't charge a commission to trade? I believe what happens here is that your fill price on either the buy or sell side is just slightly higher or lower than you would get when paying commissions. I have purchased stocks below the bid/ask spread even though the ask always appears on the screen to be above my bid. In a no commission situation, I may not have picked up that stock. Consider that in some situations, over 1000 trades are completed within a minute of trading. You will never see the 16 trades per second flashing by you as you sit and monitor the order screen.

Many people still enjoy the interaction of a full service broker and a hand shake to conclude the deal. But for the rest of us, online stock trading is impersonal and demands that you place the order yourself. Also full service brokers are really only designed for long term buy and hold investing. Imagine day trading with a full service broker. In almost all cases, the trade would be gone before the broker picked up the phone.

Ignoring commission free trading, stocks can generally be purchased through online discount stock brokers for as low as $1 per 100 shares or up to approximately 2% of the trade through a full service broker. For instance, let's say you want to buy 500 shares of a $20 stock. The commission to buy and sell this stock would likely be between $10 (5*2 trades) if you used an online discount stock broker or up to $400 (2 x 10,000 x 0.02) if you work with a full service broker.

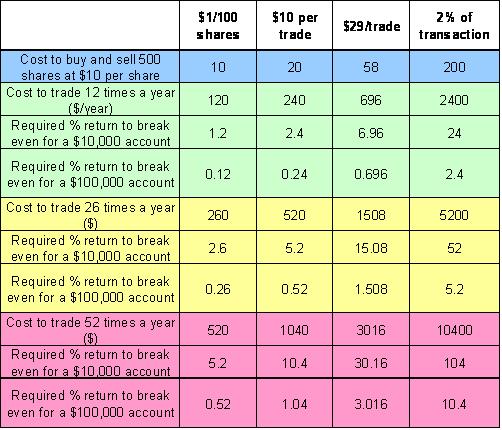

Let's look at the table below. It details how much you would be required to make to break even, on a percentage basis, in a year of trading. The table is broken down into different sized trading accounts.

Yearly Performance Needed vs Account Size

Let us see what happens for different situations. The table below shows that for a $10,000 account you would need to make 24 percent per year just to break even if you are using a full service brokerage firm, paying 2 percent per trade and trading 12 times a year. On the other hand, using an online discount broker, you would only need to have a return of 1.2% if you were paying $1 per 100 shares.

In this table, the cost of one trade covers the buying and selling of the stock.

Full Service Stock Brokers

From the above table you can see that when you trade a lot and use a full service broker you are at a major disadvantage as when you trade 52 times in a year you will require 10.4% gain just to break even.

A full service broker does provide a service. Generally, the more commission you pay the more you get. In the above table, a full service broker would likely charge around 2 percent to buy or sell a stock. If you find a good broker, they should help you identify when and what to buy. They should keep you informed and educate you.

Discount Stock Brokers

For a $1 per 100 shares, you generally get a discount broker, who will carry out your transaction. You get no advice on what to buy, when to buy or when to sell. You are responsible for making the trade yourself likely on either the Internet or phone and your monthly statement will likely be either sent to your e-mail address or viewable in your account.

The above table helps you understand that the more you pay to trade the less you should trade and the more of a long-term trader you need to be.

Online Broker Reviews

For reviews and detailed information on brokerage companies which service the Canadian Market, MoneySense has provided a review which you can read here. They provide their thoughts on the 10 best stock brokers and provide pros and cons for each one.

Interested in opening a US account, Motley Fool has a review a number of stock brokers.

To learn more about the types of questions you should be asking before you sign on the dotted line check out the questions we ask when looking for a stockbroker.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00