Stock investing vs stock trading

Don't confuse stock market trading with stock investing

Long ago, I thought that stock investing, stock trading and being an investor were the same.

Now look at my views.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Investing in stocks: Stocks for the long term

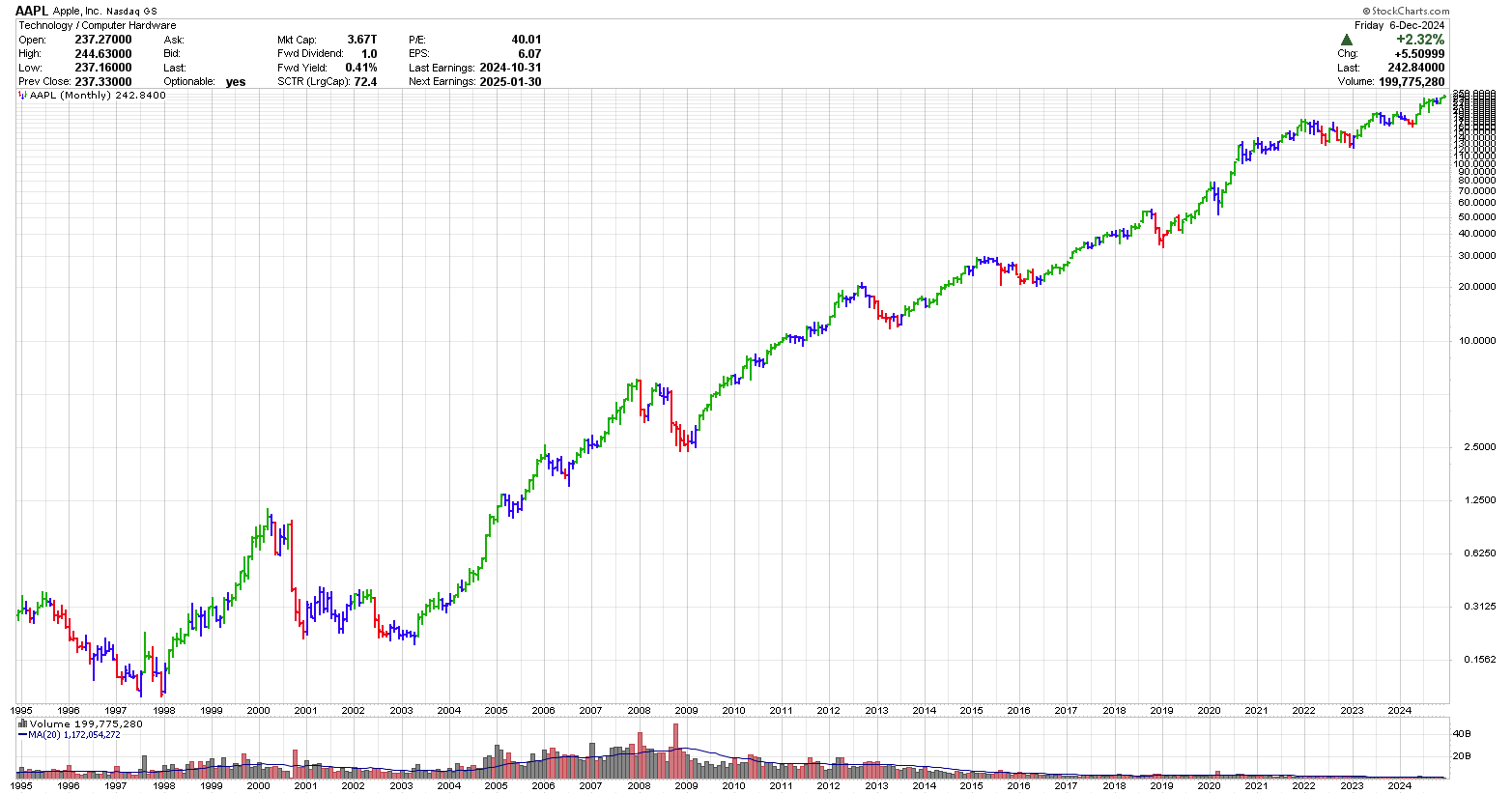

The stock market chart of Apple, shown below, identifies the type of stock price appreciation that an investor would be happy with. this is a 30 year chart which looks amazing now yet over those 30 years, the investor would have had to suffer through many large declines and years where the stock went no where.

Stock investors make money in up trending markets. Generally they would not short a stock and they would, as a rule, lose profits in a downturn.

Chart courtesy of StockCharts.com

The most common example of someone who invests in a stock is Warren Buffet. He has the ability to identify great companies, which will increase in value over a very long period of time. Properly done, investing in a stock is a long-term (years to decades) process. Sometimes new information may become available months after your purchase, which would change your outlook resulting in a sale.

Read "The Warren Buffett Way" by Robert G. Hagstrom for more detailed information on stock investing.

Identifying a fundamental change in the economy and riding this change is one way for an investor to do well in the stock market. For instance, looking at the long term gold price you may be able to identify that around January 2024 there was a long term change taking place in the gold market. Gold finally traded over $2,000 US an ounce. A stock investor could take this information and buy a number of mining related stocks and ride the cycle. However, because of the cyclical nature of the mining industry, typically these stocks would not provide good long term profits unless there was a major move in the price of gold and the investor sold the shares near the top.

Stock Trading: Stocks for the short to medium term

Trading stocks is a a way a lot of traders get into the markets. There are 3 major ways traders trade stocks:

- Stocks can be traded intraday (buying and selling within one day)

- Swing trades which can last from a couple of days to a couple of weeks

- Position trading which can last from a couple of weeks to months. Some trades may extend to years if you get lucky enough to ride a long-term trend.

Stock traders would love to find a long term play like AAPL shown above however, they would not hold it for the entire period. Depending on the traders style, would depend on the number of trades they would take. Stock traders will also short a stock, that is they would play the stock to the downside in a bearish market.

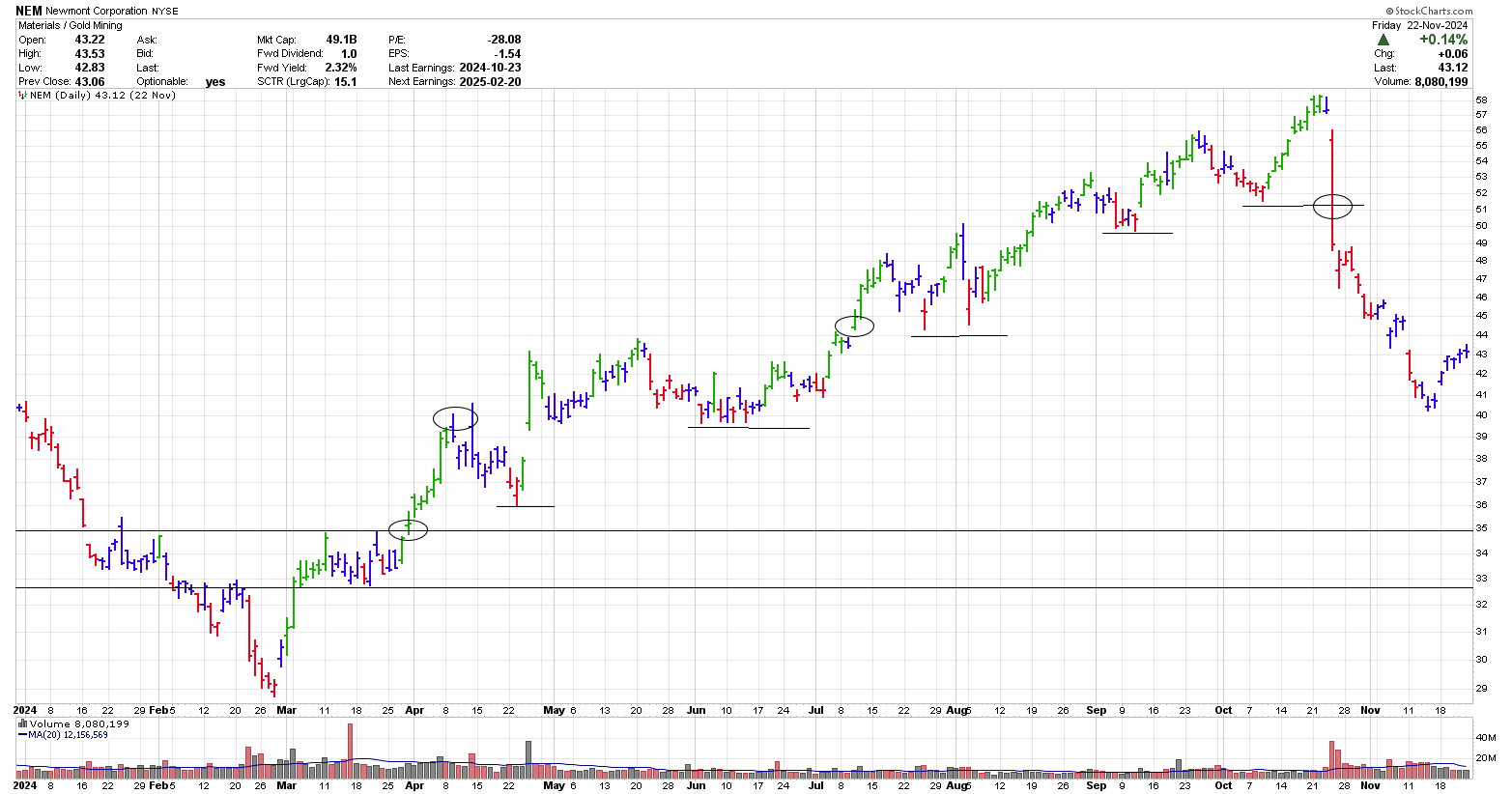

Consider the trade below on NEM could have been initiated purchased on March 28, 2024 at $35.01 on a higher high. The stop loss is put in at $32.69 for a risk on the trade of $2.32. The trader decides to sell 1/3 of the position at 2x risk and another 1/3 at 4x risk. After the first profit target, the trader will raise their stop to the most recent low after a new high is reached.

The FPT is reached on April 9 at $39.65. The stops are then raised as the price moves higher. The SPT is taken on July 10 at $44.29. The stops are moved up until there is a large drop in the price on October 24 due to earnings and the final 1/3 position is sold for around $51.39. This would qualify as a position trade as it lasted almost 7 months.

Chart courtesy of StockCharts.com

Stock traders can buy long or sell short, trade stock as well as indicator patterns or trendline breakouts. You do not need to know anything about the company you are trading. Basically, all you need to know is if the chart you are trading presents a good probability of success. Other than that you need to know when to get out when you are proven wrong.

Investor: A person who invests in anything for cash flow and/or capital appreciation

While investors play the stock market, they may also participate in a number of other alternate investment strategies. Some of these alternate investments could be businesses, real estate, antiques, cars and any other collectibles. A true investor does not care what vehicle they use to obtain wealth, provided they enjoy it.

Stock investing and stock trading are simple to do. Just about anyone can open up an account, deposit a few thousand dollars and start to trade. Just because it is easy to do does not mean you will make any money doing it. Getting in and out of stocks is easy until you lose a few times then it starts to get a bit difficult.

But what about other investment vehicles?

For a good discussion on alternate investment ideas, read my book summaries on residual income page.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00