Building a Stock Market Trading System

Your stock market trading system should fit your lifestyle

Once you begin to understand the stock markets, you should be able to set up a stock market trading system, which fits your personality, time commitments, risk tolerances and interests.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

A stock trading system is essentially a set of rules used by a stock trader to cover the whole trading process. That is, it identifies which stock to buy, how much to buy, when to buy and when to sell.

You need to ensure that the system you are using to trade fits you and does not cause you any emotional issues. A good example would be someone who works a day job and wants to day trade. The main North American markets are open from 9:30 am to 4:00 pm Eastern Time. When you work during these hours this is going to cause issues at some point. However, when you live in the west and can trade from 2 hours prior to going to work, this could be workable for some people.

To construct your own stock market trading system some of the things you need to consider are:

- Your family;

- Where you live;

- Your time lines;

- Your personality;

- Your account size;

- Your life schedule;

- Your risk tolerance;

- How much are you paying in brokerage fees;

- The amount of time it takes you to buy or sell a stock;

The goal is to design a simple stock trading system that fits your life.

Let's look at some things that occur in your life.

If you have a $10,000 account and a broker who charges 2% per trade then you likely want a stock market strategy that buys very infrequently and rides long gains. You cannot afford to trade frequently. If you do, you will likely lose all of your money to commissions. Alternately, to get around this, switch to a broker who charges low fees where they just buy and sell and you do all of the research into which stocks to trade.

When you have a Monday to Friday day job then you will likely not be day trading.

When you cannot sell a losing stock then you may want to consider other ways to invest, instead of trading. Perhaps finding a firm you trust to handle your money would be a better idea.

When you cannot sleep at night because you have a large position in a stock, you may need to rethink your position size.

If you have decided that none of the existing systems you have found fits your life and trading style, what do you do? How do you go about building your own trading system?

A Basic Stock Market Trading System

First, you need to identify a concept that you want to trade in a specific market and determine how profitable this idea is over many cycles. For instance, look at 3 different years and the results you theoretically would have achieved.

Then you would want to determine what your risk tolerance is. Are you okay losing $500 per trade or would $100 be a better starting point?

You will need to identify how you would get into a position. Will you just buy the market or use a buy stop.

Finally, how will you exit the market. Will you use a pattern, trendline breaks or do you just want to buy and hold.

When you can do all that then you can make a stock trading system that fits your lifestyle.

Building a Basic Entry System

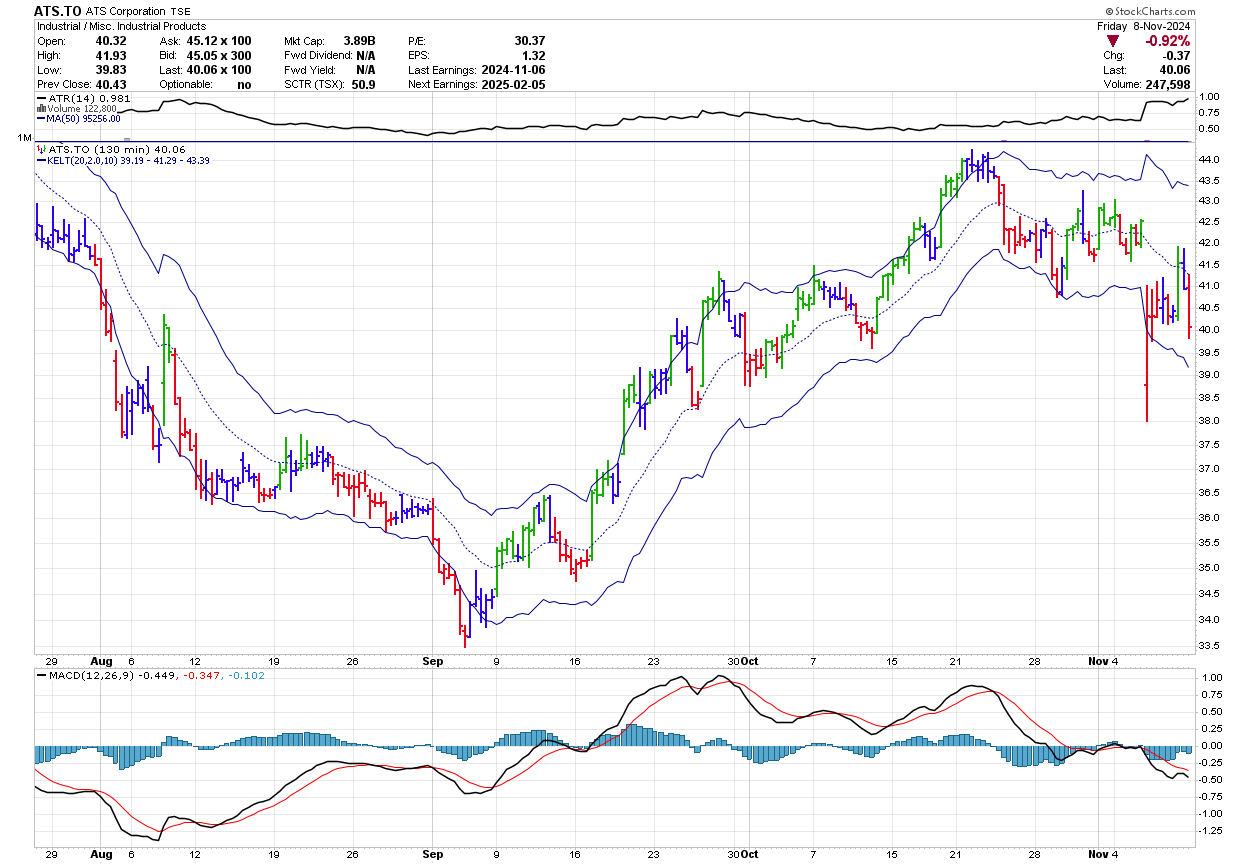

Let's look at a basic divergence entry system which can be found in Alexander Elder's book "The New Trading for a Living". This type of setup can be seen below in a chart on ATS.TO in early September 2024. The divergence occurs when the price reaches a new low yet the MACD (line or histogram) makes a higher high.

The trigger for this can be a higher high with a stop loss just below the low in price. Alternately, you can place your stop 1 ATR(14) below the low for a little more protection which also increases the risk on the trade. When looking at which one of these exits to choose consider that with the higher risk you will likely get stopped out less yet you will make less on each trade.

As in many things in trading, it is your choice.

For this trade, there are also two potential entries, the first one being on the higher high on September 9 and the 2nd one being on the higher high on Sept 16. To exit the trade, keep moving your stop loss up to just below the low of each inflection point when a new high has been reached. This would results in exiting the trade near the end of October or early November.

Chart courtesy of StockCharts.com

If you are interested in building your own trading system and want to

learn more, you can begin by understanding how other stock traders have

built their trading systems. Reading the books written by experts in our

book summaries section is one way to go about building your own stock market trading system.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00