Build Stock Trading Strategies That Work For You

Stock trading strategies consists of many parts. These parts are the entry system, the exit system, a method to reduce risk and a money management system. For every trader there are multiple ways which are likely acceptable for each of these four parts. Thus, for any one given trader there are multiple stock trading strategies. A very good understanding of this point is presented in the Market Wizards a book by Jack Schwager. In this book, Jack interviews many top traders and all of them use different systems, which tells me that the system is not important part, it is the trader.

When I write a trading plan, I always put the following statement into it:

To win, I must do certain things in a certain way. To win, I will use this plan to interact with the market. Using this plan is the way I gain control over the market. It is one way out of thousands of ways I could have chosen, i.e., there is nothing special about this plan. This plan, only identifies setups, it is how I manage the trade which will make me money.

The reason I put this statement into my stock trading strategy is to remind me that the strategy is only as good as the trader. It has been well documented, by many trading coaches, that after teaching multiple students the same strategy and then presenting them with a number of trades some of the students will go bankrupt others will break even and others will make a lot of money. Thus, it is very clear that the system you use has very little to do with your ultimate profits. However, you have to start somewhere.

Most beginner traders feel that the entry point is the most important part of a stock trading strategy. In case you didn’t realize it, from the above paragraph, the trader’s mindset is actually the most important part of all stock trading strategies. However, the average trader likely does not want to hear about this, they just want to know how to get into the trade. Thus, you could give them an absolutely perfect system and when their mindset is not correct they will lose money and blame the system. It is always easier to find another system than it is to improve your mindset.

Building Stock Trading Strategies

On this page, I want to walk through the building of an entry system. By becoming a member of stockcharts.com you can use the code here to find potential candidates. You can also modify the code as you see fit. Since the average trader always feels that their setpoints are better than anybody else’s setpoints I suspect that the first thing you will do is change some of the setpoints and that is totally fine because they are chosen for me not for you.

I got the initial idea for this concept from an article called “Simplify It” which I found in the November 2015 issue of Technical Analysis of Stocks & Commodities magazine. The only line that I took out of this article was to buy on a close above the eight period moving average of the high. Jake Bernstein, a well-known coach, commodities trader and the author of an excellent book called the The Investor's Quotient: The Psychology of Successful Investing in Commodities & Stocks, which I highly recommend, also uses a similar system. Since I was already vaguely familiar with the concept I thought I would explore it further.

Stock trading strategies can be used in multiple time frames. Typically, I trade off of daily or weekly charts simply because there is less work involved, I don’t need to monitor the price action as much, I can easily do this while maintaining a full-time career and I stay in the trade longer which typically produces greater profits. However, there are times when I would like to do a quick trade just to keep the money flowing. Thus, for this entry method, I will be working off of daily charts.

The Code

The code below can be used on stockcharts.com as written or as mentioned above you can change it as you see fit. For instance, you might just want to look at penny stocks or you may not be interested in stocks below $20 and so you will need to adjust these parameters. You could also change the volume parameters. Alternately, you could decide that an eight day moving average is too short or too long. You might want to use an exponential moving average instead of a simple moving average. I have used the weekly averages in this code to ensure that the trend is essentially up. When you don’t care if the trend is up on a weekly basis then you might want to remove these filters. As I said in the beginning, this is just a code to find potential trades, that’s it. It is not the Holy Grail, you will still need to work.

[type = stock]

and [Close > 1]

and [Close < 50]

and [[[country is Canada] AND [Daily SMA(30,Daily Volume) > 100000]]

or [[country is US] and [close < 10] AND [Daily SMA(30,Daily Volume) > 500000]]]

and [exchange is not PINK] and [exchange is not OTCMKT] and [exchange is not OTCBB]

and [Close > SMA(8,high)] and [1 day ago Close < 1 day ago SMA(8,high)]

and [Close > SMA(30,Close)]

and [Close > weekly SMA(30,weekly Close)]

and [Close > weekly SMA(15,weekly Close)]

Typically,

over the longer term I expect approximately 50% of the trades to be

winners and 50% to be losers. On the winning side, likely 10 to 20% will

be large winners, 30 to 40% will be average winners, 45 to 48% will be

average losers and perhaps 2 to 5% will be large losers.

One way you can increase the number of large losers and large winners is to play the pharmaceutical game. When the Food and Drug Administration (FDA) allows or denies a drug for a small company the stock can go through the roof or floor resulting in a large gain or a large loss. There is absolutely nothing you can do about it since the majority of these decisions are made when the market is closed so there is no way to get out of your position even if you know the result before the market opens. If this scares you then don’t trade pharmaceuticals or biotechnology stocks.

An interesting book on stock trading strategies is Tom Hougaard's Best Loser Wins which contains a lot of counter intuitive ideas about winning in the market.

Persistence and Staying in the Game

As

has been documented in multiple books, websites and workshops in a

typical year, most traders make most of their money from the 10 to 20%

of stocks which ultimately become large winners. This is one reason your stock trading strategy needs to allow you to "ride your winners". While it would be great

just to buy these stocks and forget about the rest typically, you don’t

know when you buy which ones are going to become the big winners.

Now

the above code will give you a large number of hits. Some days it may

only find 10 stocks while other days it might find 50. It is then up to

you to determine which ones you want to trade. You may decide that none

are worth trading and wait for another day. As always, this is your

choice. So, at this point, you need a method to determine which stocks

you’re going to trade. For myself, I delete all stocks which:

- Are highly volatile as I can never figure out where I would get out. If I can’t figure out where to get out then my risk is too great so I don’t take the trade.

- Have already had a major move. Of course stocks that have already moved 50% in a month could continue their uptrend but I typically look for a less risky trade. When the stock has risen sharply and then had a period of consolidation then I may consider taking the trade.

- Have low volatility. In some cases stocks move so slowly that it is just not worth purchasing them. If over a whole year they’ve only moved 10% then I am really not that interested.

- Have overnight gaps. These are typically found in stocks which are traded in markets in Europe or in Asia. These stocks are very evident on daily charts as they are filled with gaps. While some of these may be very good trades they also increase the risk so I typically don’t trade them.

- Have low volume. Typically, this can be handled in the code. However, sometimes there’s movements before holidays in which the volume is extremely low. In some cases I might take this trade, it really depends on the set up.

You may have other criteria which you use to delete a number of stocks which are found by the above code. Ultimately you only want to take the best trade for you and it is better, in many cases, to move on or wait for another day if you do not find anything which you feel is worth trading. As you build your various stock trading strategies, you should include what you will and will not trade. By making a decision upfront about what you will and will not trade you will simplify your process because you have pre-made a decision

Trading Examples

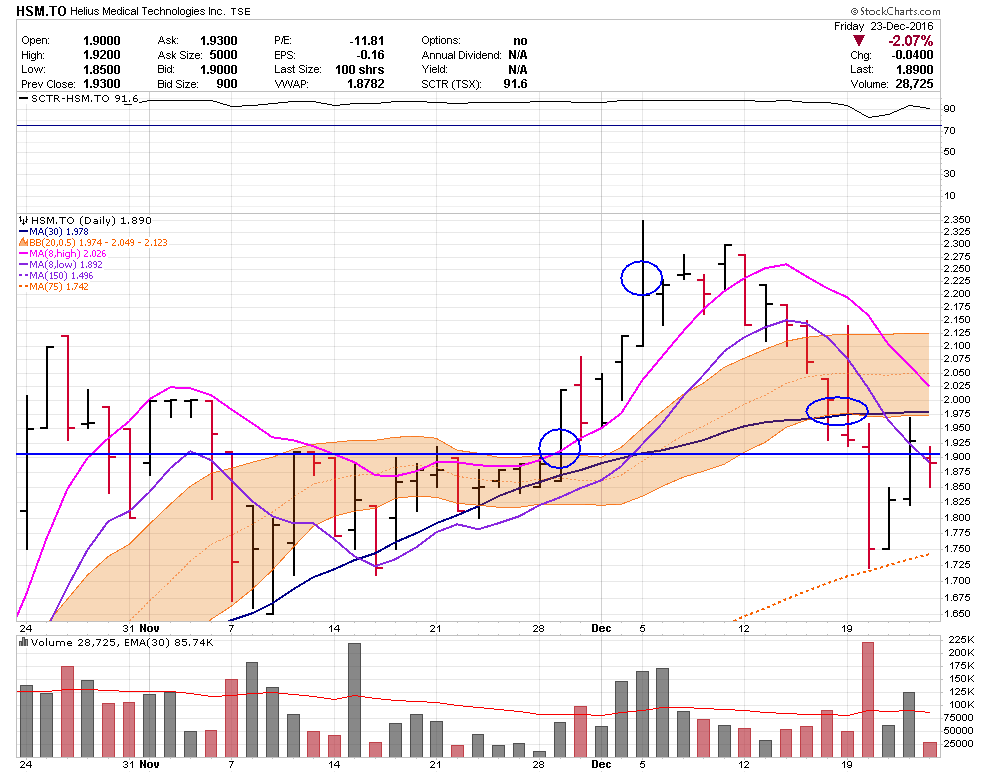

In some cases, I

find that the code above alerts me to stocks that are building a base.

That is, the stock is either building a sideways consolidation or an

ascending triangle. In these cases, I will place a buy on stop just the

above the high of the pattern. This is shown below in a trade that I did

on HSM which is traded on the Toronto Stock exchange. In this case, the

volume averages I used were lower than shown in the above code. I saw the stock on

the cross of the eight day moving average two days before it broke out. I

placed a buy on stop just above the highs and picked up the stock while

I was at work. I sold half of my position around $2.20 and the last

half just above the purchase price of $1.91. In hindsight, I should’ve

sold at $2.09 which is just below the low of the largest high-volume day

on December 5.

Charts on this page are courtesy of StockCharts.com.

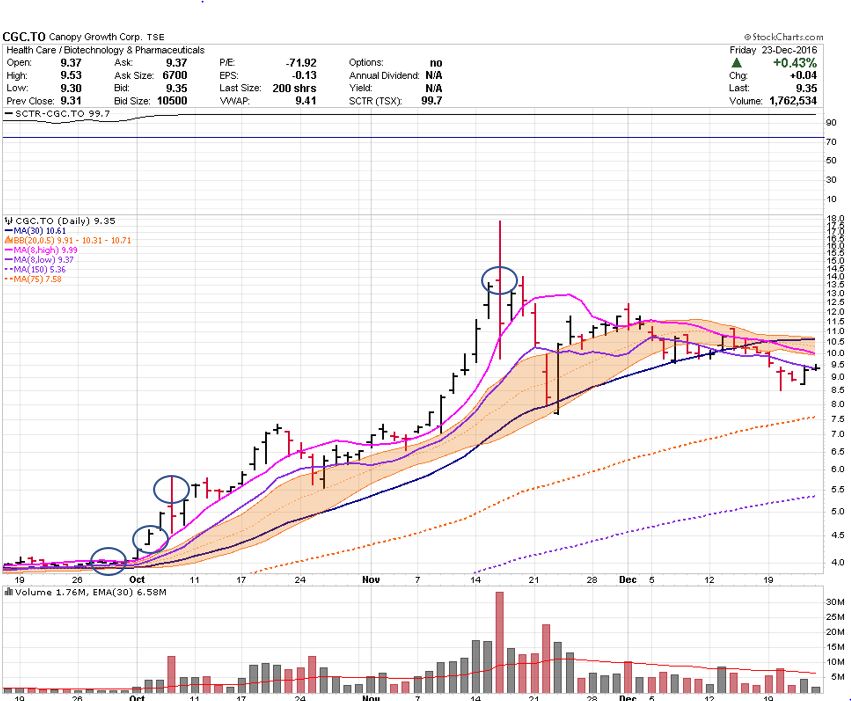

One of the biggest winners I’ve had to date

using this stock trading strategy was Canopy Growth. I picked this up in late

September 2016. I sold half of my position after a 10% move, and then a

quarter of my position around $5.50 after they announced that they had

signed with Snoop Dogg. I sold another 15% at the open on November 16,

which was the day the stock went crazy and did a reversal.

Just to ensure you that not all stock trades work out I

have included a losing trade which I did around the same time period. In this case the stock had a high-volume move

above previous resistance and look like it was destined to go up

however, I pretty much purchased it at the short-term high and sold

quickly thereafter as it broke down. This is one reason why you need to

get out as quickly as possible once you identify that the stock is

not doing what you expected it to do.

Summary of Stock Trading Strategies

So, to summarize, stock trading strategies consists of many parts. The above discussion talked about the entry system which many people believe is the most important part of the stock trading strategy. Unfortunately, while it is an important part, it is not the most important part. For instance, you can get in at the perfect point in time, miss the selling opportunity and then end up losing money. What was more important, your entry or your exit strategy or perhaps your mindset?

Dr. Alexander Elder presents a good path forward for those who want to learn to trade with more depth in his book Come Into My Trading Room.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Short Course

Introduction on How to Trade Stocks for Beginning Traders

New to trading, not sure where to start. I have put together a short course consisting of 18 lessons. Each lesson should take less than 5 minutes to review. Each lesson provides you with alternate resources to continue learning about that particular topic.

To learn more about this course and sign up please visit the course webpage by clicking the link below.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00