A Stock Trading System

Can Keep You Out of Trouble

A stock trading system is essentially a set of rules used by a stock trader to determine which stock to buy, how much to buy, when to buy and when to sell.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Do you have a stock trading system?

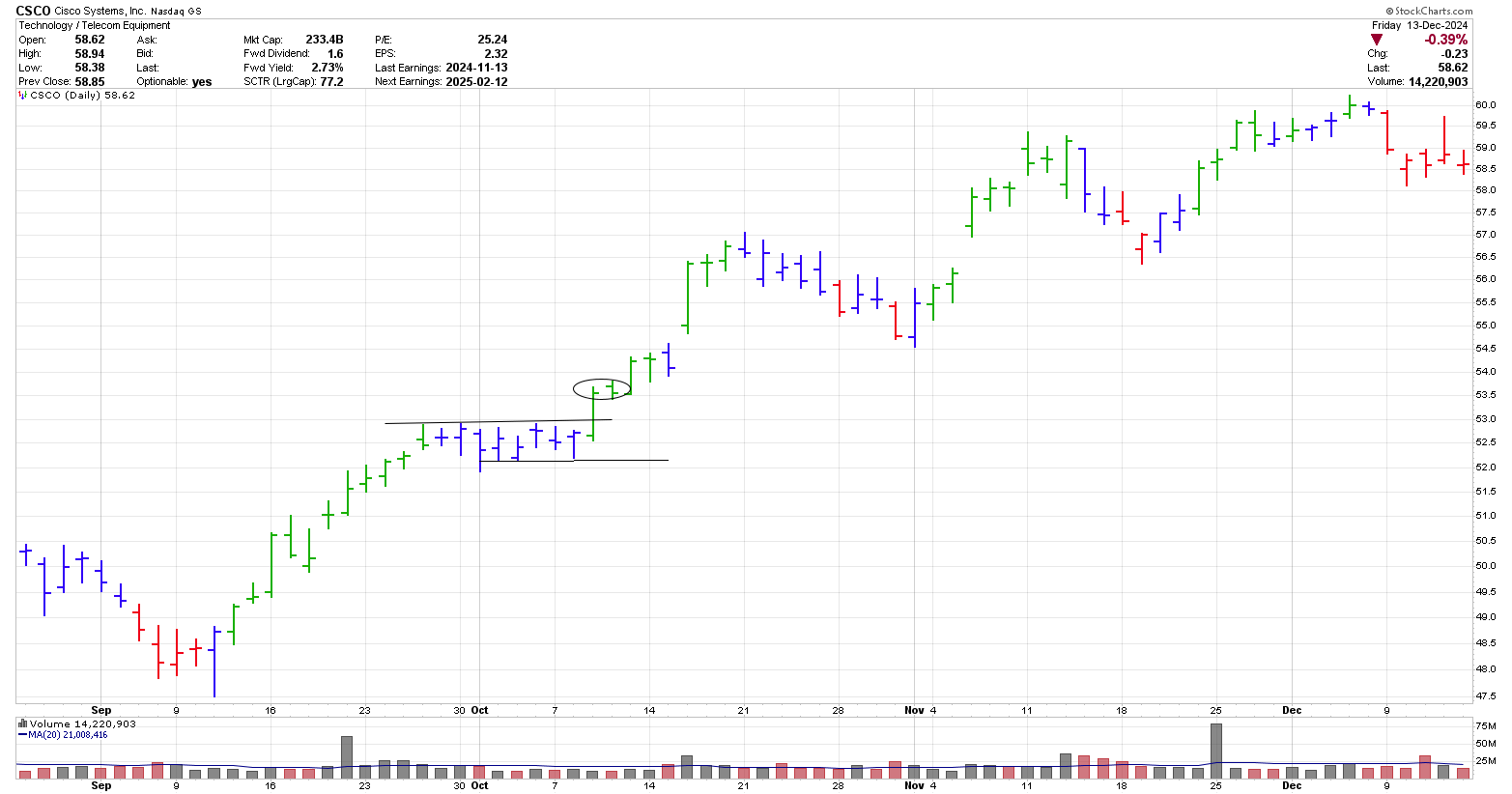

Below is displayed the basics of an entry system that a swing or position trader may use. A full trading system is much more detailed than the entry signal.

- Buy rising stocks on a breakout from a minimum 3 day consolidation

- Place sell stop below the consolidation

- Only risk a maximum $100 loss if I am wrong

- Sell first 1/3 at 2x risk

- Move stop to break even, then to each inflection point

Visually, the stock chart below shows how the above trade would have been carried out by the trader. Depending on when the trader did their search, CSCO could have been bought at $53.56 at the close or $53.70 at the open the next day. With a stop at $52.09, the risk on the trade would be $0.68 when entered at the close. Selling 1/3 the postion at 2x the risk would have resulted in the first sale on The stock would have been sold on September 16 on the gap open at around $55 at which time the stop would have been moved up to the buy point.

Chart courtesy of StockCharts.com

The trader would then patiently wait for the story to unfold. The trader would move their stop up to $54.49 on November 6, 2024 as a new high been reached. The stop would then be moved up to $56.39 on November 26 when price hit a new high. By mid December, the traders looking at the situation and thinks that a lower low may be materializing and as such they moved their stop to $57.99.

Note, as in all trading, some of these set ups result in a loss.

For the purposes of this site, stock traders generally use one of four stock trading systems:

No system - These people buy and sell stocks randomly. They have really no idea on what they are buying, why they are buying and have no idea on when to sell. There is a good chance they do not know if the stock is in a bearish or bullish cycle. They learn nothing from each transaction and tend to continually repeat their mistakes. This obviously is not a good system to use.

Black Box Systems - If you look around in the trading world (magazines, Internet, and conferences) eventually you will see ads like this:

245 trades with only 2 losses

2398 % in 3 years

Doubled my money in a month

These headlines are meant to pull you in. Many of these stock trading systems have been optimized on historical data. There is a good chance the ad is true, but you will likely never repeat the success. By our definition, a black box is a system someone else has perfected. These systems generally tell you what and when to buy and when to sell. They do not teach you how to trade better. The good ones are expensive. If you are heading in this direction, do a lot of research before you buy. A system optimized for one period is highly unlikely to repeat itself.

Taught systems - You have probably seen ads in your local newspaper like this:

Come to a free two-hour seminar and

we will show you how to make money trading stocks

These people are also selling you a stock trading system, their system! There is an advantage, generally in the free introductory lecture you get a feel for what you will learn in their more expensive one to two day workshop.

These workshops generally cost between $ 500 to 5,000. For this you normally get training, a binder of information, generally a website or software stock-searching system, hands-on training, one on one coaching after the workshop and other offers. In many cases, the monthly maintenance costs are waived for a few months after the course.

After this period, there is generally a few hundred dollars required to maintain your subscription level. If their system is well thought out this can be a valuable learning experience and potentially can start you down the road to being a better trader.

To read my review on a course which I attended many years ago put on by invest tools please follow this link.

Teaching yourself - there are hundreds of books and websites on trading. When you can identify some of the better ones you should be able to use the information in them to improve your trading skills. Ultimately, you should be able to develop your own stock trading system. A number of useful books have been reviewed on this site.

To expand your awareness into stock trading systems and how to design your own, consider Trade Your Way to Financial Freedom by Van K. Tharp or The New Trading for a Living by Dr. Alexander Elder.

You can find a number of book summaries on this website that may help you as well when you are looking on building a stock trading system.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00