Use Stop Loss Orders when you Cannot Monitor the Market

A stop loss order is an order you place with your broker which is activated only after the price of the stock touches or goes below a specific price. As an example let’s say that you purchased a stock at $20 and did not want to lose more than 5%. You would then place your stop loss order at $19. As long as the stock trades above $19 your position would not be sold. However, as soon as one person completes a trade at or below $19 then your stop order would be entered and, in theory, you would be taken out of the trade.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Why use a stop loss order?

The main reason you are using a stop loss order is to ensure that when a stock goes against you, you will be taken out of the trade, no questions asked.

Many people find it hard to pull the trigger once they see a stock going against them. However, it is relatively unemotional placing a stop loss order when the stock price is above your stop price.

Will people be able to see my stop?

The answer to this question is broker dependent. Some brokers place your order into the market as soon as you submit it while others hold it until the price point is breached and then enter it. You will have to ask your broker which practice they follow.

Can I lose more than my stop value?

Yes, you can lose more than your stop price. This can happen in a thinly traded market, when the price gaps below your stop or when the market is moving fast. To limit what you are willing to sell your stock for you can use a stop limit order.

What type of stop loss orders can I place?

There are generally two types of stops orders traders can place. They are limit and market.

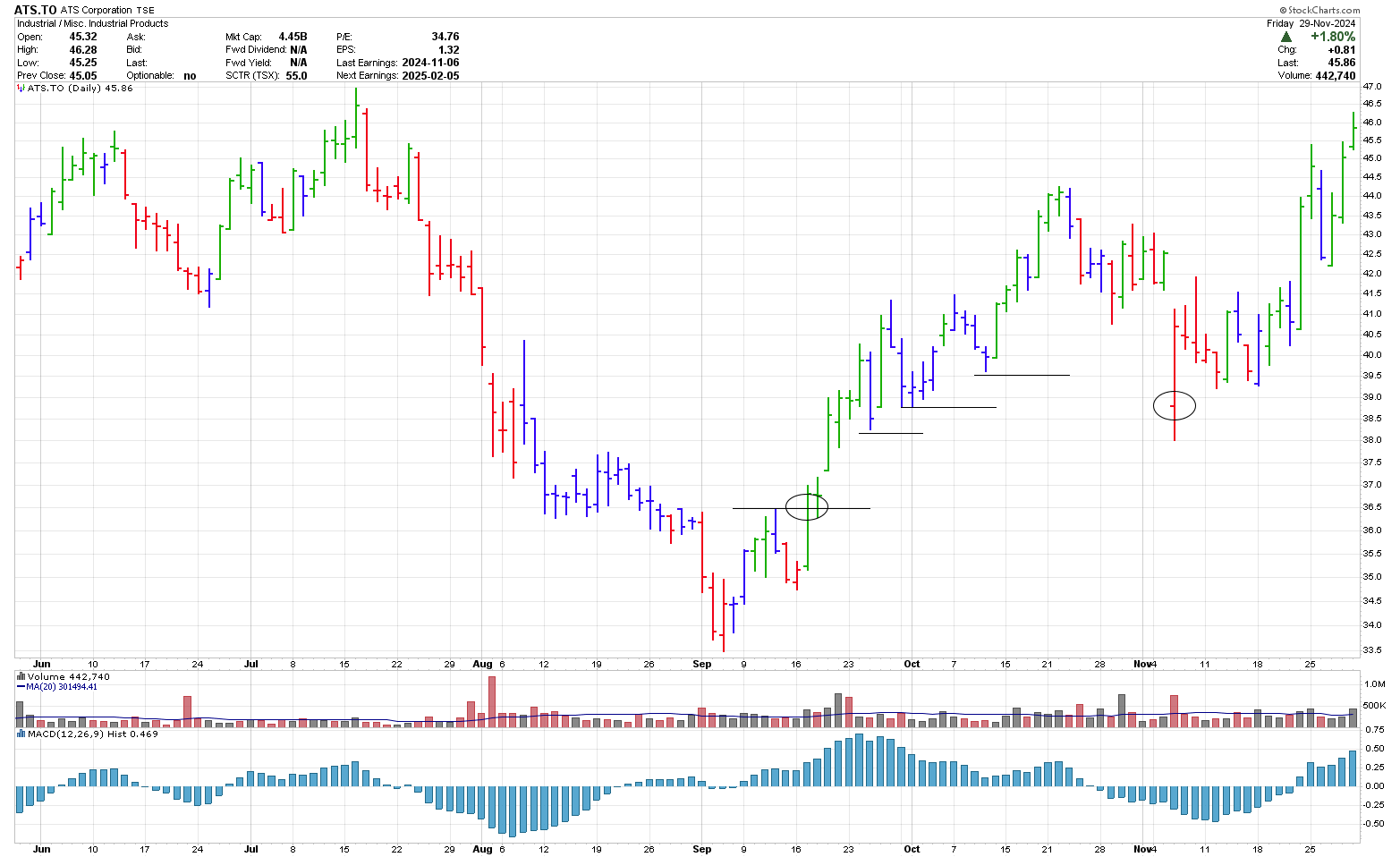

For a stop market order, once triggered, the fill price will be what ever the market is at the time the order gets filled. This can be below, at or above your market order. As an example, consider the daily stock chart of AST.TO shown below.

On the night of September 13, you decide that there is a potential for a higher high to form provided price can go above the high on September 12. So you enter a buy stop and get filled at 36.51. You then continually move up your stop order with each successive higher high. On October 10, 2024 you would have had a stop entered around $39.59 which is just below the low.

As a result of the gap down on November 6, due to the results of the US Presidential election, depending on what type of order you entered will determine your exit price.

Had you entered a Stop Market order, your order would have read sell at the market when price goes below $39.59. As price gapped down below the $39.59 stop price, at the open, your shares would have been sold for around $38.79 which is near the opening price and you would have had some slippage.

On the other hand had you entered a stop limit order with a stop at $39.59 and a limit of $39.50, once price recovered to $39.50 you would have been filled.

While a stop limit order in this case was the better order, there are times that the price keeps dropping and you will not get filled. This can result in a large loss and you may end up holding a stock for many months or years when it does not recover.

Advantages

The main advantage of placing a stop market order with the broker is that you will always know that when the market moves against you, you are protected. This can bring peace of mind to many traders and is a sure way to know that the first loss will be the best loss.

Disadvantages

The main disadvantage is that on occasion you will be taken out of the stock and the price will quickly revert back above your stop price. In some instances, you will end up selling at or close to the low of the day and while this can be frustrating it is just part of the game. Provided you can accept this and not get extremely frustrated the advantages outweigh the disadvantages.

Of course if you are the type of person that can sell a stock once it reaches your predetermined sell zone then you do not really need a stop as long as you have access to the market during the day, are able to check up on your positions from time to time and can sell the stock when the market indicates that it is time to sell.

In a nutshell, a stop loss is used to protect you such that you can trade another day.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Short Course

Introduction on How to Trade Stocks for Beginning Traders

New to trading, not sure where to start. I have put together a short course consisting of 18 lessons. Each lesson should take less than 5 minutes to review. Each lesson provides you with alternate resources to continue learning about that particular topic.

To learn more about this course and sign up please visit the course webpage by clicking the link below.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00