Trading Signals

So many to choose from, which is right for me?

Match up your trading system with your personality

and trade with more confidence

Stock trading signals are what most traders seem to be looking for when starting to trade stocks. Everyone is looking for the magic formula which will bring them instant profits. Unfortunately, there is no one signal that works in all markets all of the time or for all traders. When something works every time and is easy to implement then everyone would be doing it and the end result would be that it would not work any more.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

There are multitudes of trading strategies out there. They do not necessarily need to be complex as it has been shown that with a good money management system, even choosing stocks by flipping a coin, as discussed in Trade Your Way to Financial Freedom can make money.

In the first version of Jack Schwager's book "Market Wizards: Interviews with Top Traders it was concluded that all of the traders in the book were making money and everyone was using different trading signals. This tends to indicate that the trading signals you use within your trading strategy are not the most important part of the trading system.

In Trade Your Way to Financial Freedom Van Tharp argues that trading is 90% psychology. Many other traders suggest psychology is only about 70%, money management is around 20% and knowing when to get in is really only about 10% of what goes into a good trading system.

Having said that, it is the trading signals that everyone is looking for so this is why you find so many different trading signals out there.

To be sure, when the trading system you use does not match up with your trading psyche then you are bound to lose before you even begin. A trading system includes the trading strategies you will use to get in and out of the market as well as your money management methods.

When you are a long term trader and are using a short term system it is unlikely you will ever succeed. Think of it this way, if you were looking for a safe, reliable car to transport your three kids around town would you buy a two seater sports car. Likely not.

You need to match your trading or investing ideas with your trading system. You can trade pull backs, breakouts, high volume moves, gaps, increases in volume, moving average cross overs, reversals, higher highs, range bound stocks etc. And you can also hold positions for different lengths of time so you need to know where you will do the best: as a day trader, swing trader or position trader.

Trading Signals - Which one to Choose?

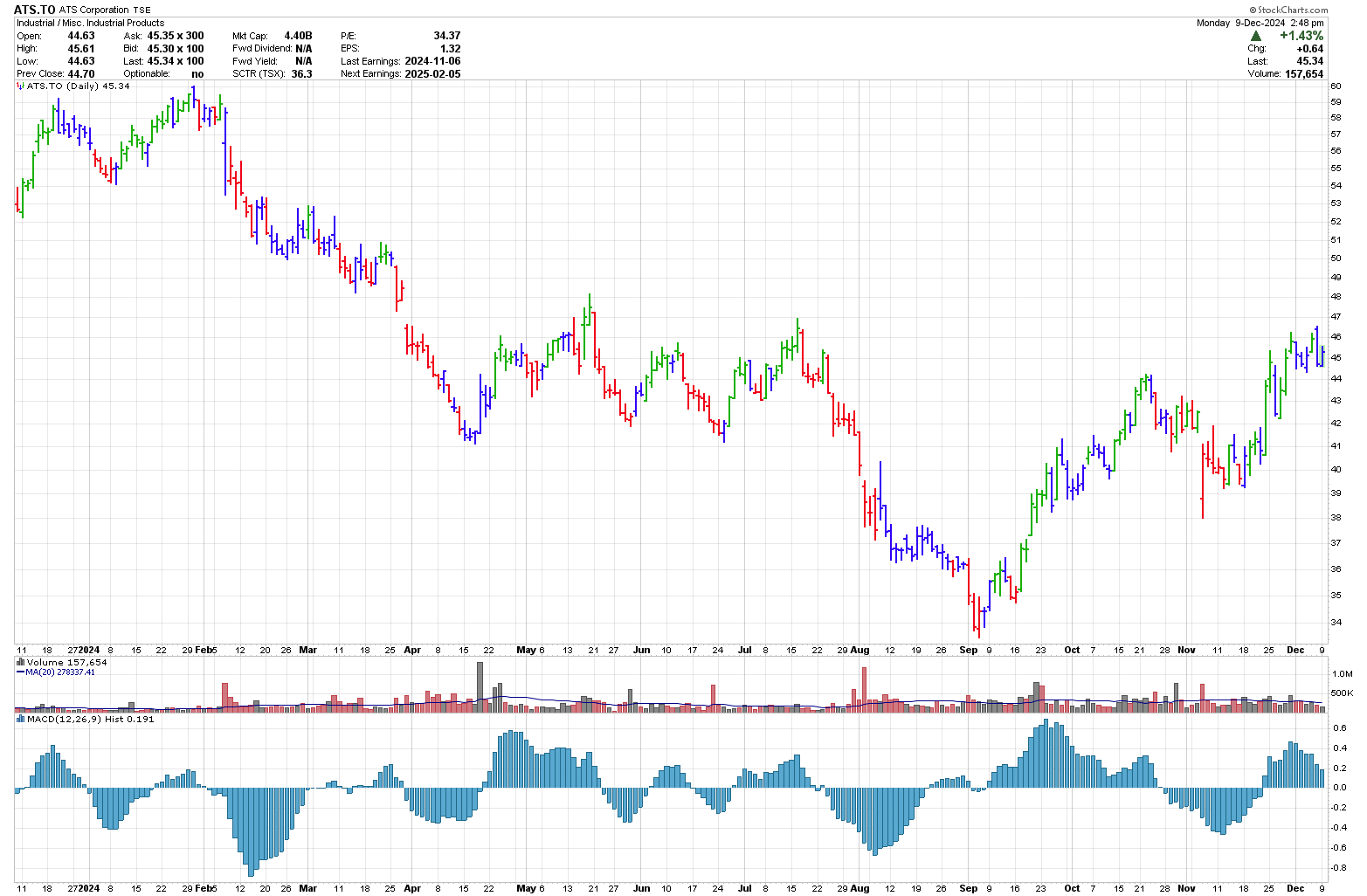

Consider the chart below which only has 3 indicators on it. The bar colors are based off of Elder's Impulse Sytsem. The volume is shown under price and a standard MACD histogram is shown by the blue bars on the bottom.

Chart coutesy of StockCharts.com

Trading signals are typically really easy to see after the fact. In the moment they tend to be a bit fuzzy.

In the above chart there are two realatively obvious divergence trades as highlighted by the MACD.

The first divergence is seen when price made a new high in late January and the MACD histogram did not. Selling short or buying a put could have been done around February 8 depending on what you are using for your trigger.

There was another divergence on September 5, 2024 where there is a new low in price yet the MACD is making a higher low. In this case, there could be two different ways to enter the trade. The first trigger would be when the MACD moved above the MACD in late August. The second entry would have been on September 17 as price moved above the high of Sept 12 forming a higher high.

Note, that in the above case, both of these trading signals worked. This is not always the case.

When you start to look at what you want to do, check how you feel emotionally. Can you sleep at night? Does your body start to give you bad vibrations when you go about trading a certain way? When this happens listen to your body, it knows what it prefers.

If you want to gain a better understanding into what goes into a trading plan take a look at a one page trading plan I wrote. I use variations of this plan as I develop new trading systems. This plan will give you a better understanding as to what goes into a trading system other than trading signals.

It can be difficult to identify with a trader you have never met. However, in some cases, you can get an idea of the types of systems which are out there by downloading a few chapters of a book. After reading or sifting through the material you should be able to identify if this trader/educator aligns with your ideas. When you align with a trader/educator and want to further your relationship you can do this by owning some of their material. I have reviewed a number of popular trading books and you can view a summary of these trading book reviews to learn a bit more about trading signals.

Remember, your aim as a student of the markets is to learn at least one new thing with each trading system you investigate. When you can continue moving forward, one step at a time, you will ultimately reach your goal.

Interested in starting to build a trading plan then see how I have included trading signals in my trading plan.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00